Edit Your Practice’s Procedures, Codes, Adjustments, and Prices

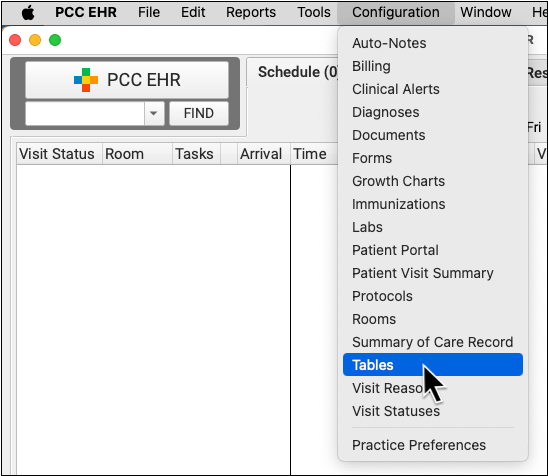

When you need to add a new billing code to your PCC system, create a new version of a code that includes modifiers, or adjust your practice’s prices for procedures or adjustment types, use the Tables tool in the Configuration menu.

Watch a Video: Watch Edit Your Prices and Billing Procedure Codes for a video tutorial of these steps.

Procedure Code Guidance: The procedure codes discussed in this article are intended only as examples. You should consult the AMA’s current CPT Coding Guide and work with your insurance payers to verify what codes you should report on claims. Your practice updates and maintains your billable procedure list, codes, and prices in the Procedures table in the Tables configuration tool on your PCC system.

Contents

Edit Your Practice’s Billable Procedures, Codes, and Prices

Use the Procedures table in the Tables tool to update your practice’s billing procedures, codes, and prices.

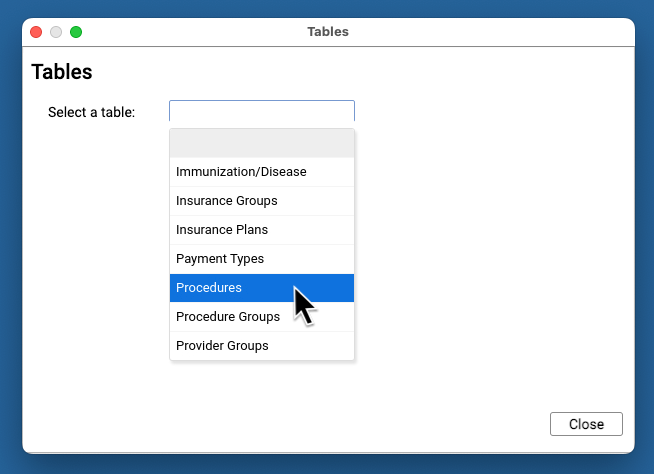

Open the Procedures Table

Open the Procedures table in the Tables tool in PCC EHR.

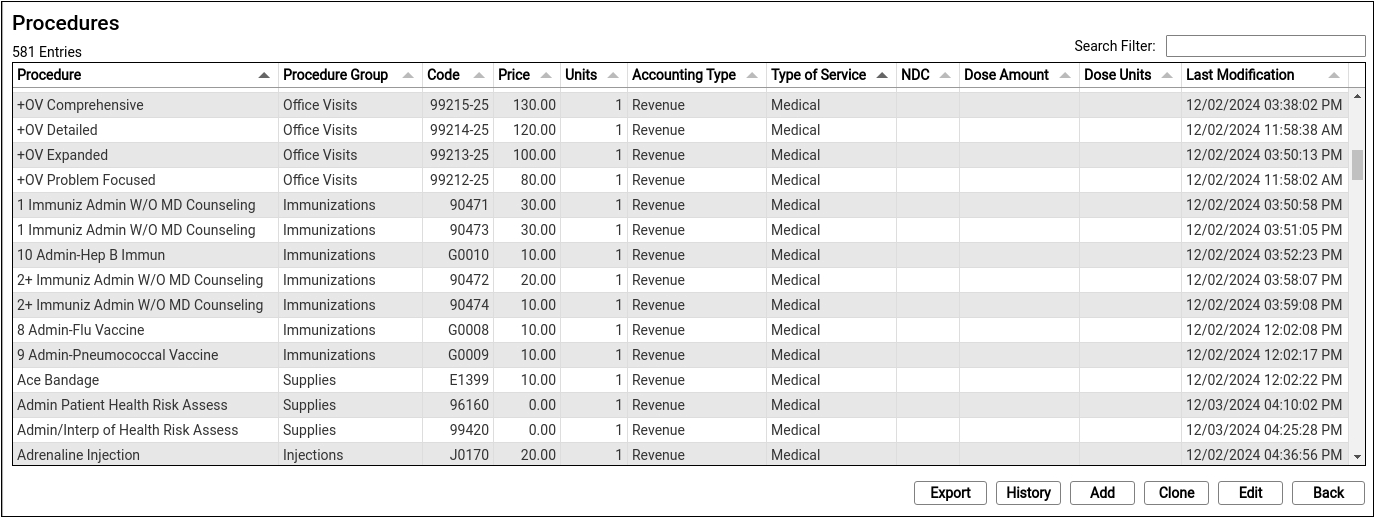

Review Your Existing Procedures

The Procedures table contains all of your practice’s billable procedures, charges, fees, as well as adjustment offsets used by your PCC system.

Double-click on an entry to open and edit the details of a procedure.

You can search for specific procedures and sort the list by different columns. Click “Export” to download a comma-separated-value (CSV) file of the entire table for use in a spreadsheet. Click on an entry and then click “History” to see a record of all changes made to a procedure.

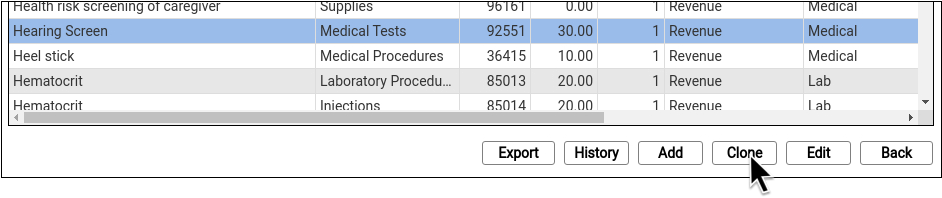

Clone or Add a New Procedure

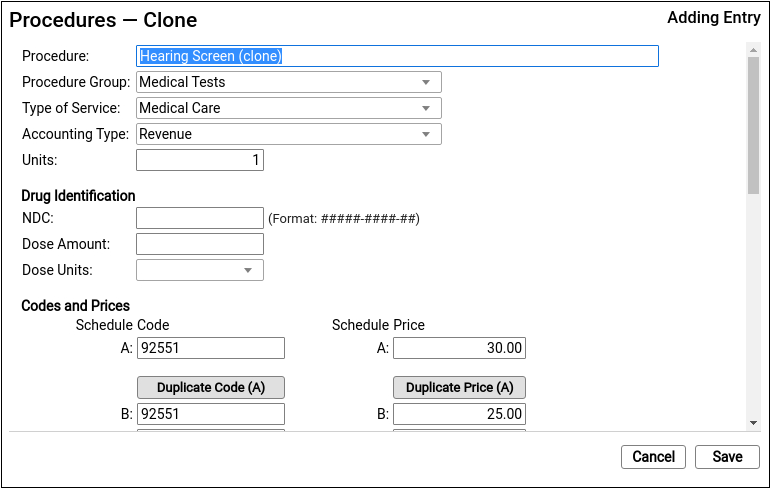

Select an entry and click “Clone” to add a new procedure based on an existing one.

It’s easiest to start by cloning a similar procedure. You can also click “Add” to create a new entry from scratch.

Do Not Overwrite or Erase the Name of an Existing Procedure: Never edit and overwrite an existing procedure entry, as this may affect your billing history. Even if a procedure has been retired and replaced with a new CPT code (for example), always clone and create a new entry.

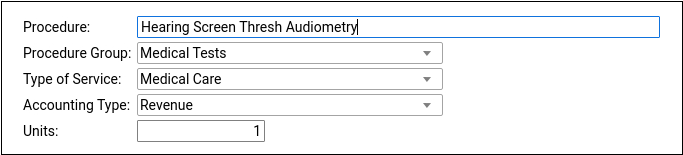

Update the Cloned Procedure’s Name, Group, Type of Service, and Units

At the top of the screen, update the procedure’s name and basic information that indicates how the new procedure entry will be used.

If you cloned an existing procedure, some of these fields will be filled out for you. For a typical billable procedure, the Type of Service will be “Medical Care” and the Accounting Type will be “Revenue”. See the sections below for a complete reference.

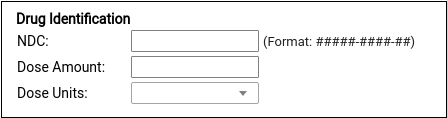

Optional: Update Medication Fields

If the procedure is an immunization, injection, or a drug you administer at your practice, enter the NDC and dosage information that will appear on the claim.

Enter the NDC code for the smallest administered dose; use the code found on the vial, not the box or carton. Read Add and Configure Immunizations for more tips on filling out these fields.

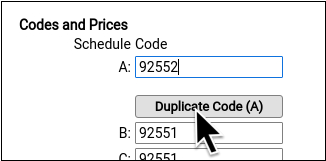

Enter the Billing Code

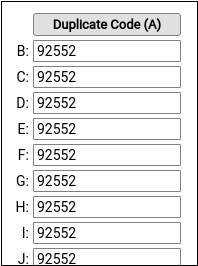

Enter the procedure billing code in the procedure code field for Schedule A. Then click “Duplicate Code (A)” to populate the alternative code schedules.

Under rare circumstances, your practice might enter different codes, or a code with a modifier, in different schedules for particular insurance payers. See the sections below to learn more.

PCC does not provide or distribute CPT billing codes, and the example above is for illustration only.

Enter Your Price for the Procedure

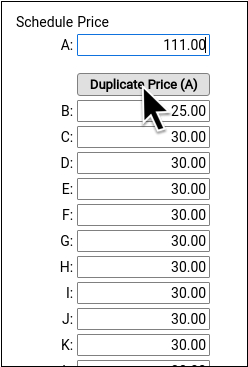

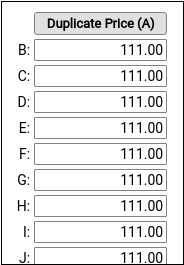

Enter your practice’s price for the procedure in the Schedule A Price field. Then click “Duplicate Price (A)” to populate the alternative price schedules.

Under rare circumstances, such as when using the same procedure for both medicaid and non-medicaid immunizations, your practice might use an alternate fee schedule for particular insurance payors. See the sections below to learn more.

PCC does not provide pricing recommendations, and the example above is for illustration only.

Save Your Changes

Click “Save” to save your changes.

Configure Orders, Billing, and Chart Notes

After you add or update a billing procedure on your PCC system, you may want to take these additional steps:

-

Contact PCC to Complete Immunization Configuration: If you are adding a new immunization to your PCC system, contact PCC Support. Read Add and Configure Immunizations to learn more.

-

Update Your Practice's Orders: When you link a procedure billing code to an order, PCC EHR will automatically add it to the encounter when the clinician clicks “Order”. Read Configure Order Billing, Diagnoses, and the Bill Window to learn more.

-

Add New Orders to Chart Notes: When you add a new procedure and configure a new order on your PCC system, you may want to add the order to chart notes. When you make an order a default on a chart note protocol, the clinician can create the order and add the billable procedure to the encounter with a single click. Read Configure Protocols to learn more.

-

Update the Bill Window: You can edit your practice’s Bill window, a.k.a. “the electronic encounter form”, to make it easy to select a common procedure or fee when a clinician codes an encounter.

Procedures Table Field Reference

A procedure includes a name, accounting type, and other values.

-

Procedure Name: You can name a billing procedure anything that will be useful for your practice. Your clinicians, billers, and the patient’s family will see this name in various contexts, such as a receipt or bill. Insurance payers do not review or verify a procedure’s name, relying instead on the billing procedure code.

-

Accounting Type: Billable procedures you perform in your practice should have an accounting type of “Revenue”. Other Account Types, such as “Receipt” and “Revenue – Non-Service” are used for refunds, insurance write offs, and other less common accounting situations.

-

Procedure Group: The Procedure Group field is a customizable value used for reporting purposes; it does not usually affect billing or how a procedure is ordered or completed.

-

Type of Service: The Type of Service field was originally used to indicate a code on claims, but it is no longer part of the claim standard. For most procedures performed by your practice, use “Medical Care”. If the procedure is a lab, select “Diagnostic Laboratory”. When your PCC system formats claims, it includes an appropriate CLIA identifier for procedures with a type of service “Diagnostic Laboratory”.

-

Units: If you always bill a procedure as a set number of multiple units, you could adjust the Units field. Normally, units are selected when your practice bills an encounter, so this field is almost always set to “1”.

-

NDC: For immunizations or drugs you administer in your practice, enter the National Drug Code. The National Drug Code is an 11-digit number used to identify the vaccine or medication you administer. NDC codes found in the Vaccine Lot Manager are used for your state registry, but are not used for billing. NDC codes needed for billing should still be managed through the Procedures Table. For examples and more details, see Add and Configure Immunizations in PCC EHR.

-

Dose Amount and Dose Units: For immunizations or drugs you administer in your practice, enter the dose and dose units found on the vial, pouch, or tube that you administer. For example, if a vaccine is administered as 0.3 mL, you would enter “0.3” and “mL”. For more details, see Add and Configure Immunizations in PCC EHR

-

Code Schedule A: The billing code that will appear on the claim for this procedure.

-

Code Schedule B-Z: Alternate billing codes for unusual configuration needs. Normally, you will click “Duplicate Code” in order to enter the same code for all schedules. PCC supports optional schedules due to deprecated “local codes”, which are no longer part of the claim standard used in the U.S. If your practice has a schedule specifically configured for Medicaid billing, and your state Medicaid program requires a modifier, you can enter the full code and the modifier into a CPT field for that schedule. PCC Support can configure which claims will use a custom code schedule. Alternatively, your practice can clone a Procedure entry and create a specific version of the procedure for Medicaid billing, for example.

-

Price Schedule A: The price you will bill for the procedure.

-

Schedule Codes B-Z: Alternate prices for unusual configuration needs. Normally, you will click “Duplicate Code” in order to bill the same price for all schedules. In unusual circumstances, such as when you have a special contract with a payor or wish to use the same procedure entry for medicaid (VFC) immunizations vs non-medicaid immunizations, you might use an alternate price schedule. PCC Support can configure which claims will use a custom price schedule.

Adding a Procedure with a Code Modifier

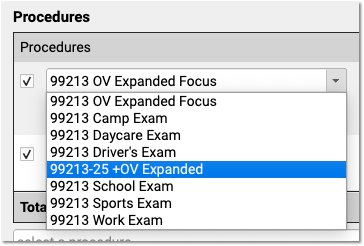

If your practice needs a code with one or more modifiers, such as the common -25, you should clone an existing procedure and adjust the clone’s title and code schedules to indicate the modifier.

Common modifiers include -25, -26, and -59, but the CPT standard and payer requirements sometimes use more complex modifiers, such as -Q6, and CMS has developed HCPCS Level II Modifiers, such as -E1, -TC, and -XS (see AAPC).

When your practice adds a modified version of a code to your procedures table, it becomes available to all users when they post charges or edit charges for an encounter.

Configure Adjustments, Fees, and Refunds with an Appropriate Code and Accounting Type

In addition to billable clinical procedures, the Procedures table includes your practice’s adjustments, fees, refunds, and any accounting item that would increase an account’s balance or offset a payment.

Claims require a linked diagnosis, so PCC’s software requires a linked diagnosis for any procedure billing code that has five or more characters, such as a “99213”. If you are creating or updating your practice’s administrative fees (or other charges that do not require a diagnosis), use a billing code with fewer than five characters. For example, if you are creating a “Forms Fee” or “Missed Appointment Fee”, you could use a billing code of “X” or “FEE”, or whatever would be clearest for your practice.

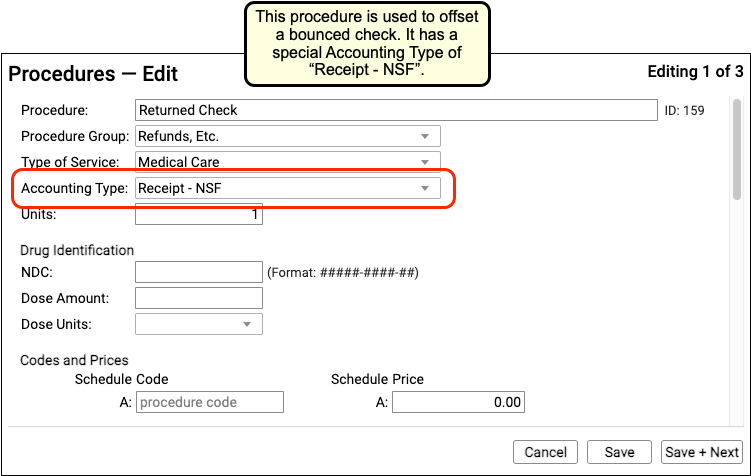

When you edit refunds, adjustments, and other unusual procedures, the Accounting Type field indicates their purpose. Various PCC reports include or exclude different accounting types, or put them in special columns, in order to provide your practice with a better understanding of your accounts receivable.

Procedure Accounting Type Reference

The table below describes different categories of these procedures, their related “Accounting Type” in the table, and how they are used for each accounting operation.

What Are Adjustments in the Procedures Table Used For?: For examples of how you would use the procedures with these accounting types, see Refund or Write Off Account Credits and Reverse a Payment.

| Procedures | Accounting Type | Explanation and Usage |

|---|---|---|

| All clinical procedures performed in a practice | Revenue | Billable procedures you perform in your practice should have an accounting type of “Revenue”. Office visits, immunizations, and more are examples of revenue procedures. You can post these procedures as charges in the Post Charges window. |

| Non-Clinical service fees | Revenue – Svc Chg | Tasks you perform for a family that are non-clinical, and have a charge, have an accounting type of “Revenue – Svc Chg”. Examples include record transfer fees, form fees, rebilling fees, and similar. |

| Fees or other non-service fees | Revenue Non-Service | When your practice charges a bounced check fee, a forms fee, or some other fee that is not billed to an insurance payer, you use a procedure with an accounting type of “Revenue Non-Service”. The procedure will appear like any other charge on the account. |

| Capitation, incentive payment, insurance interest, overpayment, or withhold payment adjustments | Revenue Non-Service | When an insurance company sends you a capitation payment, interest payment, or other type of less-common payment, you post an adjustment procedure with an accounting type of “Revenue Non-Service” to indicate what the payment is for. Then you post the payment. For more information see Post Capitation Checks, Incentive Payments, Interest Payments, Overpayments, and Withhold Payments. |

| Write off a credit that you will not refund | Revenue Credit W/O | When you wish to classify a credit on an account as income, you can offset it with an adjustment procedure with an accounting type of “Revenue Credit W/O”. This means you are classifying the credit as income to the practice, and you do not intend to refund it. |

| Returned check or other stopped payment adjustment | Receipt – NSF | When a check bounces or another type of payment is stopped, your practice negates the payment by linking it to an adjustment procedure with an accounting type of “Receipt – NSF”. You might also post a fee. |

| Credit refunds | Receipt – Refund | When you refund a credit to a family, you post an adjustment procedure to the account with an accounting type of “Receipt – Refund”. |

| Insurance takebacks and other insurance refund adjustments | Receipt – Refund | When you need to issue an insurance refund, or an insurance company issues a “takeback” for a payment you already posted, you post an adjustment procedure with an accounting type of “Receipt – Refund”. Then you link the original payment to that adjustment procedure. |