Edit the Insurance Plans On Your PCC System

When a patient or parent brings in a new insurance card, you can update their insurance policies quickly and easily. However, what if the insurance plan is entirely new to your practice? Maybe it is an existing plan, but it has a new address, copay amount, or payer ID.

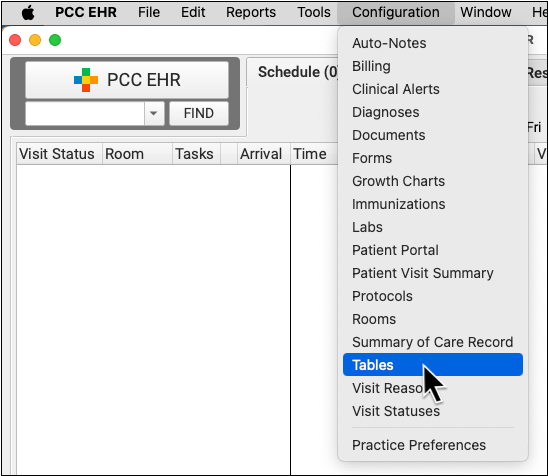

Use the Tables tool in the Configuration menu in PCC EHR to update the list of plans that your practice bills. Read below to learn more.

Video: Watch Edit the Insurance Plans on Your PCC System to learn more.

Contents

Edit the Insurance Plans on Your PCC System

Read the procedure below to learn how to review and update your practice’s insurance plans.

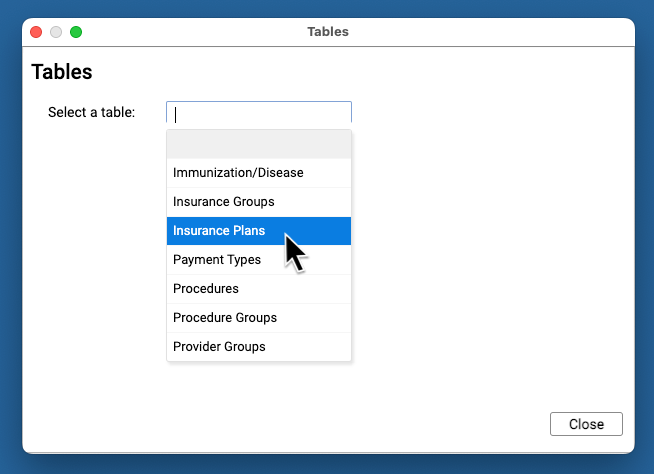

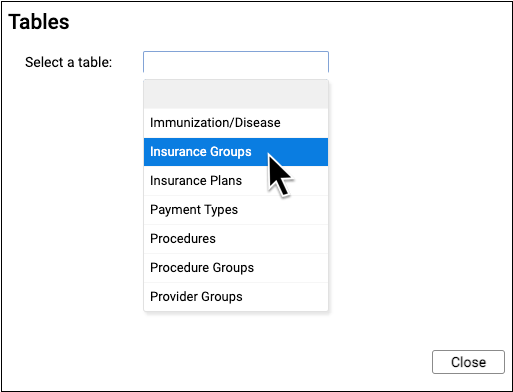

Open the Insurance Plans Table

Open the Insurance Plans table in the Tables tool in PCC EHR.

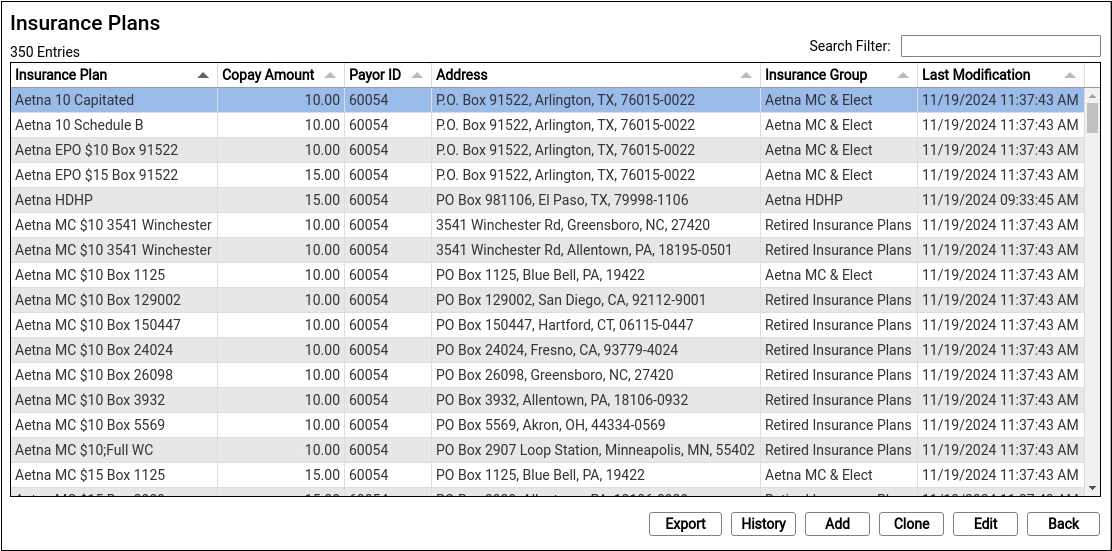

Review Your Existing Insurance Plans

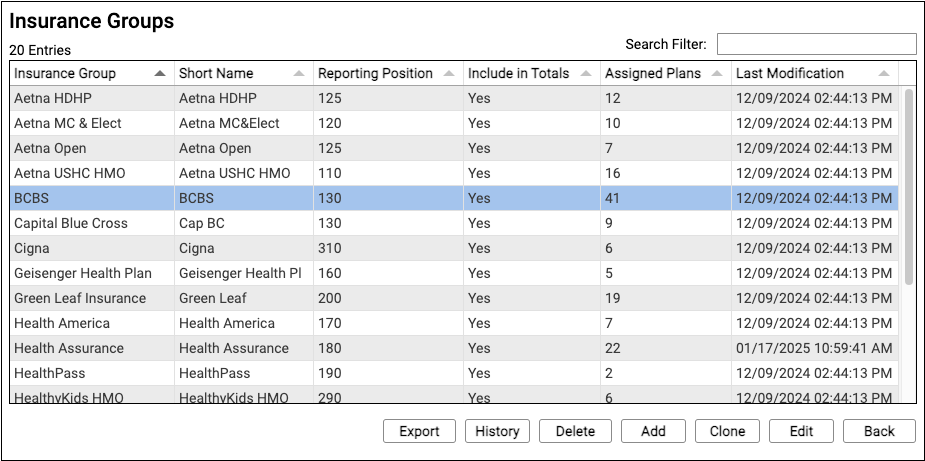

The Insurance Plans table contains all of your practice’s plans.

Double-click on an entry to open and edit the details of an insurance plan.

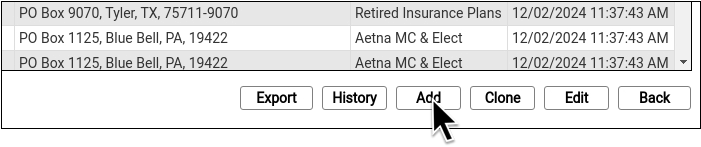

You can search for specific plans and sort the list by different columns. Click “Export” to download a comma-separated-value (CSV) file of the entire table for use in a spreadsheet. Click on an entry and then click “History” to see a record of all changes made to a plan.

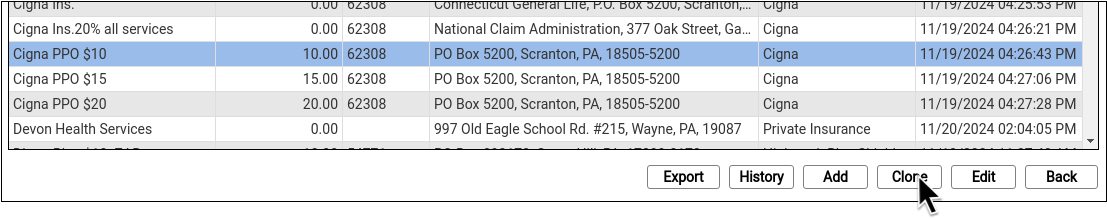

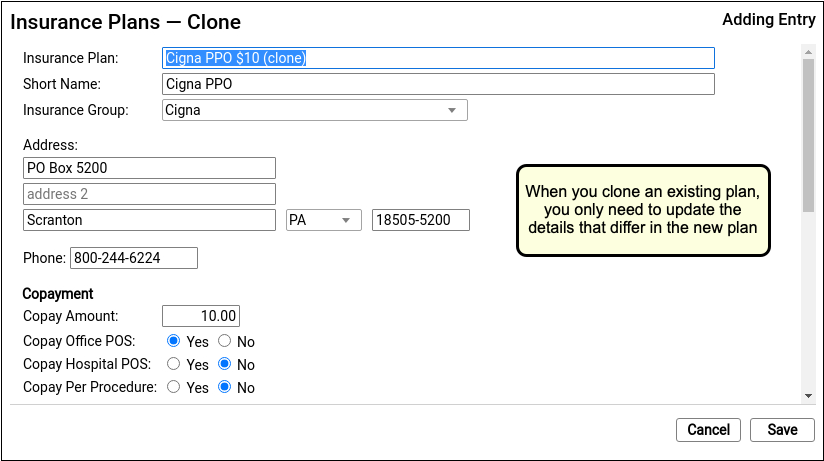

Clone a Plan

When you’re ready to add a new plan, select an existing entry and click “Clone”.

It’s easiest to start by cloning a similar plan and then updating plan details.

Do Not Overwrite or Erase the Name of an Existing Plan: Never edit and overwrite an existing insurance plan, as this may affect your billing history. Even if a plan has been retired and replaced with a new plan, always clone it to add a new entry.

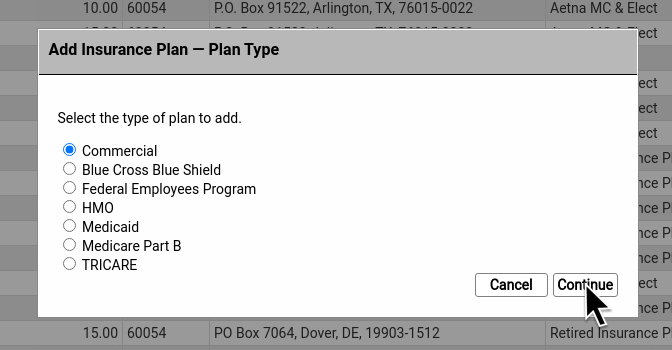

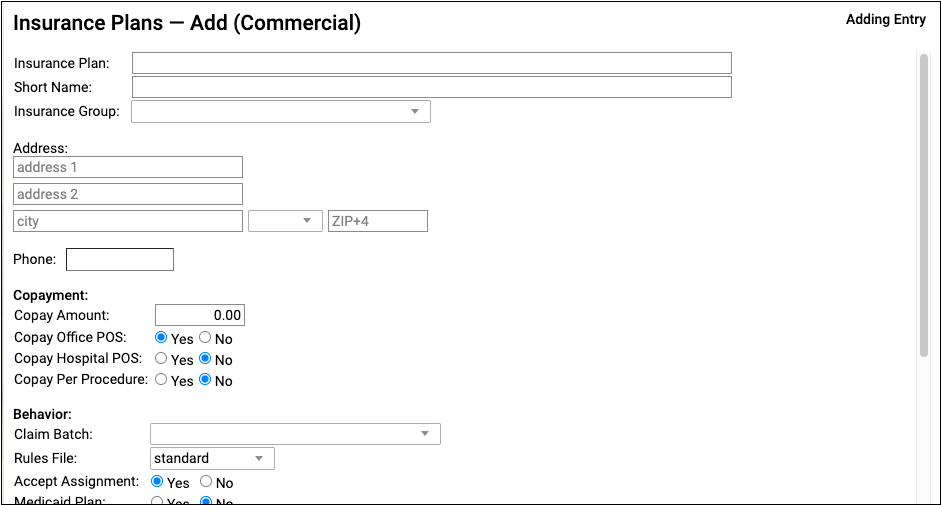

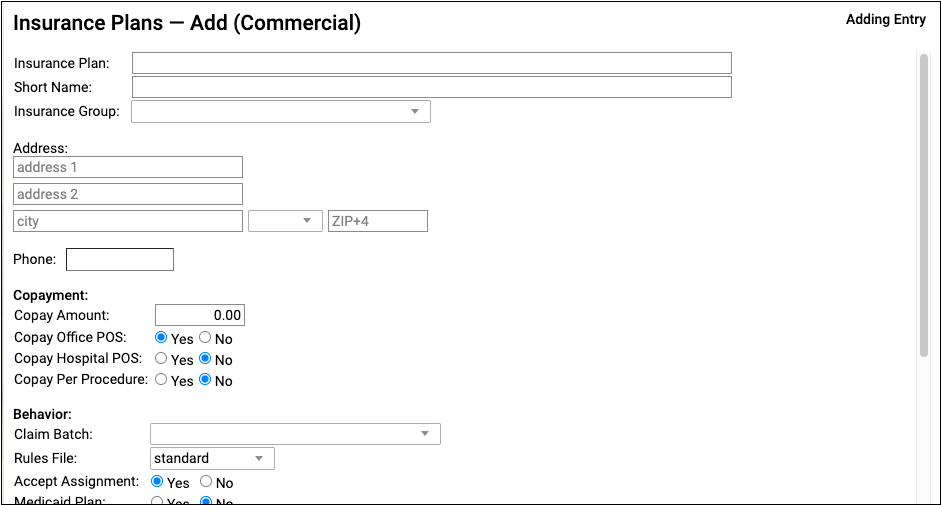

Optional: Add a New Plan

If you can’t find a plan to clone, click “Add” to create a new entry from scratch.

Then select a plan type.

Update the New Plan’s Name and Basic Information

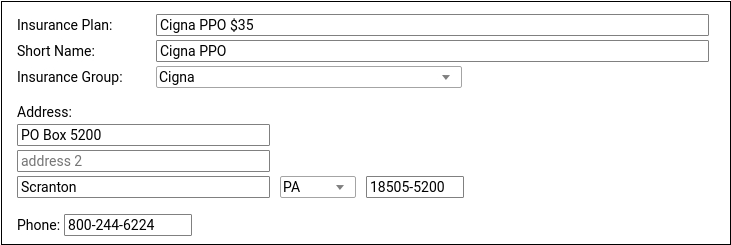

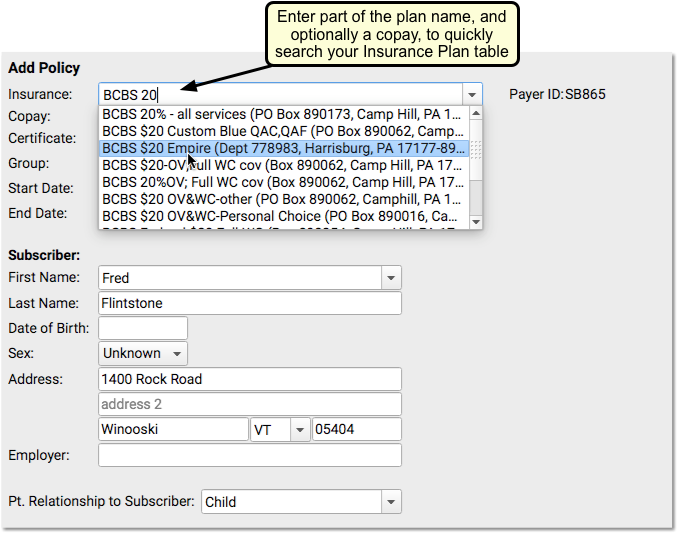

At the top of the screen, review and update the plan’s name and other information that will be used when adding the policy to a patient’s record or submitting claims.

For ease of identification, PCC recommends including the plan’s copay in the Insurance Plan field.

Update Copay Information

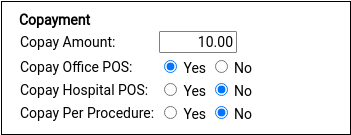

Enter the plan’s default copay amount for office visits and define any unusual copay rules used for billing.

Insurance plans with a copay typically require it for office visits but not for hospital encounters and not per-procedure. Most plans do not charge a copay for well visits, which is controlled with the rules file in the Behavior section described in the next step.

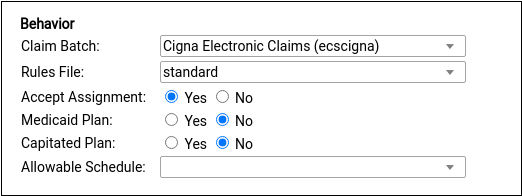

Update Claim Batch and Other Billing Behaviors for the Plan

If you cloned an existing plan, this section may be filled out for you. Otherwise, select claim processing options that will control how your PCC system will handle charges and claims for this policy. Contact PCC Support for assistance.

Under most circumstances, select a claim batch that matches the payor and select the “standard” rules file, as shown. The standard rules file puts all medical procedures on the claim and charges a copay, if the plan has one, for office visit procedures. For more information on these options, see below.

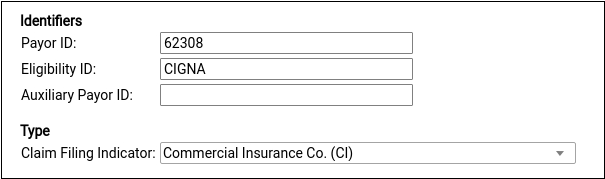

Update Payor ID and Other Identifiers

If you cloned an existing plan, this section may be filled out for you. Otherwise, update the Payor ID and other identifiers used to route claims and submit eligibility requests.

The plan’s Claim Filing Indicator will be inherited from the plan you cloned or else set for you based on the plan type you selected after you clicked “Add”. For a reference to each of these options, see below.

Optional: Enter Notes

Enter notes about this specific plan for later reference.

Notes are unique per-plan table entry.

Save Your Changes

Click “Save” to save your changes and add the plan to your system.

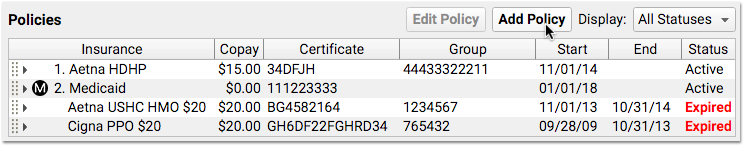

Add the Policy to Patient Records

After you add a new plan to your PCC system, you can add it to patients’ policy records.

If you have already posted charges for an encounter, you can then edit that encounter in the Billing History, make the new plan responsible for those charges, and queue up a new claim.

Insurance Plans Reference

Read the sections below to learn more details about the Insurance Plans and Insurance Groups tables in PCC EHR. Insurance tables contain information about the insurance plans on your PCC system, which are used for billing and reporting.

How Your Practice Uses Your List of Insurance Plans and Insurance Groups

When you add a new policy to a patient’s records, you pick from your practice’s list of insurance plans.

Your practice maintains this custom list of the insurance plans that you bill. That list is kept in the Insurance Plans table in the Tables tool in PCC EHR.

When you run financial reports, the totals are often grouped by payor, with categories such as Aetna, BCBS, and Medicaid. The list of payer groups that your practice reports on is kept in the Insurance Groups table in the Tables tool in PCC EHR.

Insurance Plans Table Field Reference

Each entry in the table corresponds with a single copay amount for a plan that your practice bills. The entry includes the payor’s name, address, payor ID, and other details.

Insurance Plan Name and Short Name

The plan’s name and short name indicate how the plan will appear on lists and in a patient’s policy record. Practices typically include the expected default copay amount in the plan name, making it easier to select the correct plan when adding a patient’s policy.

Insurance Group

Your practice maintains a custom list of Insurance Groups in the Insurance Groups table. Groups are used for financial reporting and do not affect claims or billing behaviors for procedures.

Address, City, State, Zip and Phone Number

These details for a plan are typically found on the back of an insurance card. They are sometimes used for claim submission and to followup on claims.

Copay Amount

The default expected copay for this plan. You should enter this information in the name of the plan as well, so that selecting the plan will be easy for your staff. A plan’s rules file can override what copay to charge for each procedure.

If a plan charges different copays for different procedures, put the default copay in this field.

Copay questions

A series of Yes/No questions that determine default copay behavior for this insurance plan.

-

Copay Office POS: Is a copay typically expected for a visit to the office?

-

Copay Hospital POS: Is a copay typically expected for a hospital visit?

-

Copay Hospital POS: Is a copay charged for each charged procedure?

Use these questions to define default copay expectations. When handling an encounter’s charges, your PCC system checks these questions and then refers to the rules file, which can override these question and define more precise copay expectations.

Claim Batch

The set of configuration rules that will be used to generate a claim. When charges are posted for an encounter and a claim is queued up, it is labeled as being part of a particular “batch” and will be processed in a specific way to meet the requirements of a payor. Plans are assigned a batch so claims will be submitted in adherence with those requirements.

A plan’s batch for claims is not connected to the plan’s insurance group, which is used for reporting, but the values may match or be similar. For example, your practice may have a reporting group for Medicaid plans as well as a special batch for handling the configuration of medicaid claims.

All Insurance Plans Need a Batch: This field normally shouldn’t be empty. It controls the formatting of your claims for the payer. If you believe you need to add a new batch, contact PCC.

Rules File

A configuration file that can be used to implement special per-procedure behaviors, overriding the default needs for the insurance plan.

When you post charges, PCC checks the rules in this file, also known as the “Special Information File”. The rules set whether procedures should pend the insurance plan at all, appear on claims, capitate, use a special price schedule (rare, as insurance contracts generally disallow this), or write off an amount or percentage of the procedure’s price. Additionally, the rules can define what copay should be charged for each procedure, overriding the Copay Amount for the plan.

If you believe you need to create a new set of rules to meet the unusual billing requirements of a payer, contact PCC. For most situations, select the “standard” rules.

Accept Assignment

If this value is set to no, charges posted to this plan will (by default) remain the personal responsibility of the billing account for the patient. The rules file can override this behavior and determine precisely which procedures will pend to the plan.

On claims, this value communicates to the payor whether or not payment should be directed to the practice or the patient. If set to no, the payment should be directed to the patient. If set to yes, the provider has a participation agreement with the payer and the payment should be directed to the practice. Your practice’s insurance configuration for this plan’s batch can override how this value appears on claims.

Medicaid Plan

A Yes/No question that determines whether this plan will follow certain medicaid behaviors by default. If set to “Yes,” then:

- The plan will always be sorted below non-Medicaid insurance policies when a patient has multiple policy coverage. (If a patient has more than one insurance policy, Medicaid policies will be secondary or tertiary, etc.) If this plan ever needs to be the primary plan in front of a private insurance, you should not set the Medicaid question to “Yes”.

- The policy will be marked with an “M” for easy reference. For example, nurses may need to grab immunizations from a different location for patients with a Medicaid-type plan. Wherever insurance policies are listed, an “M” icon will appear making it easy for them to identify that the patient has Medicaid.

- Some reports, such as those found in your Practice Vitals Dashboard, will consider the plan, and any other plans in the same insurance group, to be Medicaid-type plans for reporting purposes.

Capitated Plan

A Yes/No question that sets the default capitation behavior for this plan. If set to yes, then charges posted to this plan will be adjusted off at the time of service. However, the Rules File can override this question and configure the specific desired adjustment behavior for procedures. PCC Support will help set up and configure adjustment behaviors for capitation plans.

Allowable Schedule

The contract fee schedule used for this payer. If your practice enters your contract fee schedules into PCC, you can automatically review claim responses that fail to meet the schedule and report on overpayments and underpayments over time. For more information, see Use Contract Fee Schedules (Allowables) to Monitor Reimbursement.

Payor ID

The identification number used for electronic claim submissions to this plan. Insurance plans from the same company generally share the same number.

Where Do I Find an Insurance Plan's Payer ID or Payor ID?: If you cloned an existing insurance plan of the same company, the ID number may already be correct. Otherwise, the payor’s ID should appear on the insurance card, or you can call the number on the card. The carrier is required to provide an ID number for claim submission.

Eligibility ID

An identification number or alpha-numeric code used for requesting eligibility information for a patient. These are standardized for a given payor, so are usually easy to find on the internet. If you are unable to find an eligibility identification number, contact the payor.

Auxiliary Payor ID

An identifier used for specific situations, such as a secondary medicaid claim submission in which the primary payor required a proprietary identifier (a “Carrier Code”).

Claim Filing Indicator

A parent category for the type of claim submission used for the plan. Most commercial plans are “Commercial Insurance Co.” or “CI”. Medicaid and BCBS have unique claim filing indicators.

Notes

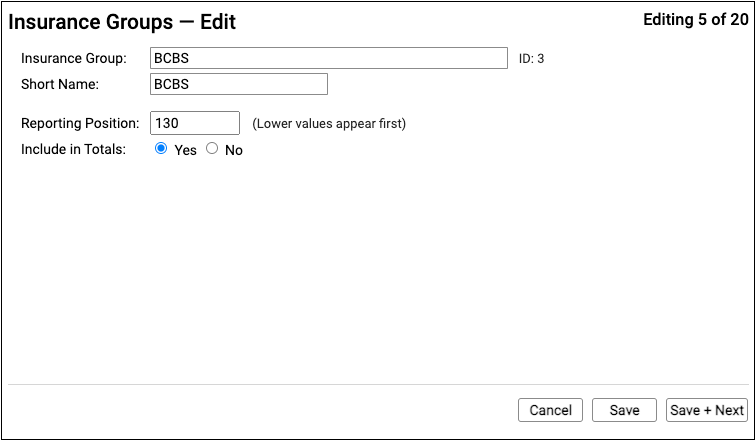

Insurance Groups and the Insurance Groups Table

The Insurance Groups table is also located in the Tables tool.

This table defines your practice’s customizable payor groups used for reporting.

Insurance groups have a name, a short name, a reporting position, and an “Include in Totals” option which indicates whether or not charges and payments for policies in the group should be included in certain report totals.

All insurance plans in the Insurance Plans table have an assigned insurance group.

If you wish to break out reporting for a subset of an insurance group, you can clone an existing group and enter a new name. Then you can assign the new group to corresponding insurance plans.