Work on Claim Errors and Rejections

After you prepare and submit claims, you must deal with claims that could not be submitted or were rejected.

Your PCC system automatically catches many problems before a claim leaves your practice; it holds back claims that contain errors or otherwise need corrections. After submission, a payor may not accept a claim because they can’t identify the subscriber or for some other reason.

In order to get paid, your practice must address both claims that couldn’t be submitted and rejected claims. Read below to learn about tools for working with claims that need corrections or were rejected.

Contents

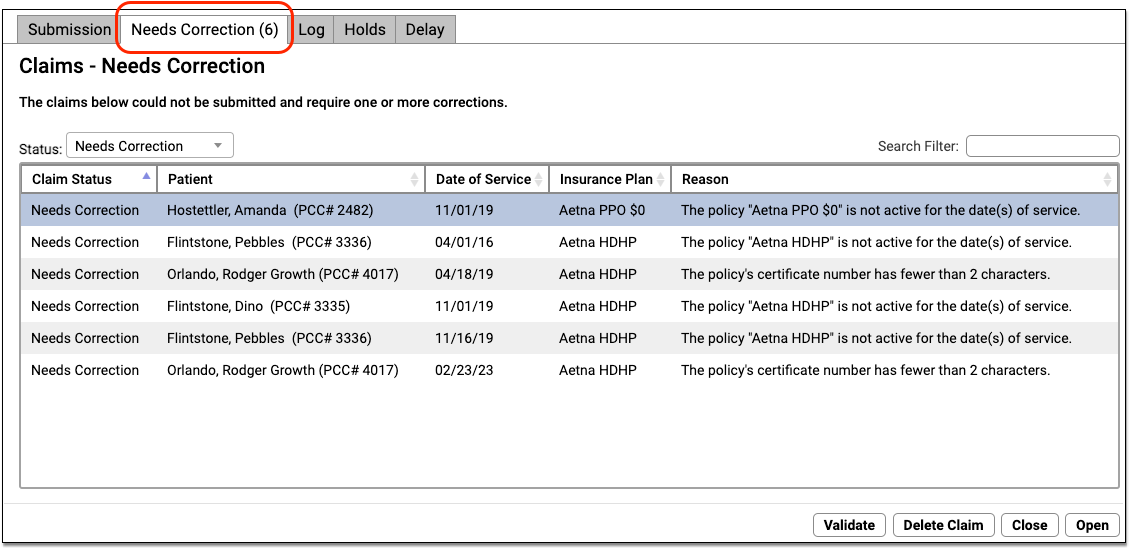

Fix Claims that Need Corrections

After you prepare and submit claims, you can review all claims that need corrections.

You can work your way down the list, open each queued claim for more information, and use tools in the Claims tool to correct the issue. The claim will then go out when you next prepare and submit claims. Claims that needed corrections are also logged in the Log tab of the Claims tool.

For more information about using the Need Corrections and Log tabs in the Submit Claims tool, read Submit Claims.

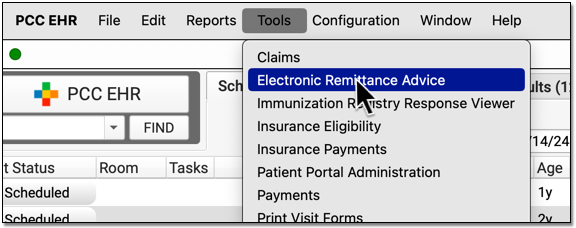

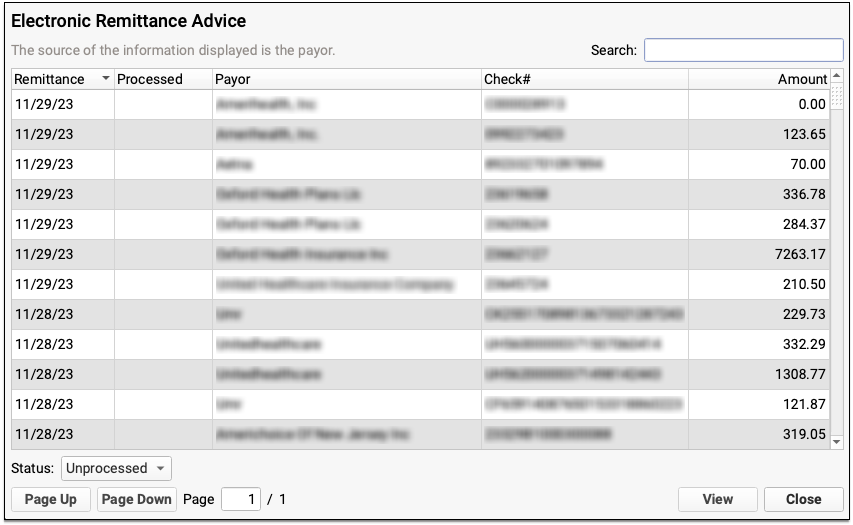

Read Electronic Remittance Advice From Payors

You can review all ERAs from payors in the Electronic Remittance Advice tool.

ERAs provide complete details about the payor’s adjudication, including payments, adjustments, denials, and unusual circumstances. Read the Read ERA 835s from Payors article to learn more.

Review Claims that Need Corrections and Claim Rejections in the SRS Billing Error Report

Use the SRS Billing Error Report, sometimes called the “Review/Correct Rejected Claims” report, to work on claim rejections. The report also displays claims that couldn’t be submitted, in case any were missed in the Claims tool. You can find the report in your Practice Management window.

By default, the Billing Error report displays all charges, sorted by account and patient name, for which the most recent status message is from a particular list, which includes claim processing errors (“Tagsplit” errors), clearinghouse rejections, and payer rejections. The report sorts the results by responsible party and then by billing status. You can identify an encounter issue, use the Correct Mistakes (oops) program to review the account and read more about the error, and then update charge information and resubmit a claim.

Most Recent Status is Not Always Correct: The Billing Error report in srs displays claims based on their most recent status. However, payors sometimes mistakenly send a claim denial, followed by a claim acceptance. The claim was “accepted” for adjudication and also denied, but the most recent message makes it appear the claim is still being processed. For this reason, PCC recommends you periodically run the Insurance Company Accounts Receivable (inscoar) report to find outstanding unpaid claims.

For more information on fixing problems and generating a new claim, read Edit Encounter Charges and Other Claim Information and Resubmit a Claim.

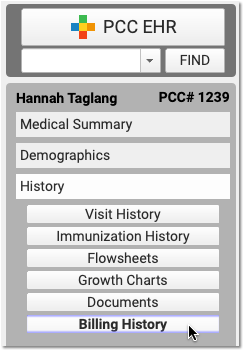

Review the Claim History of a Specific Encounter

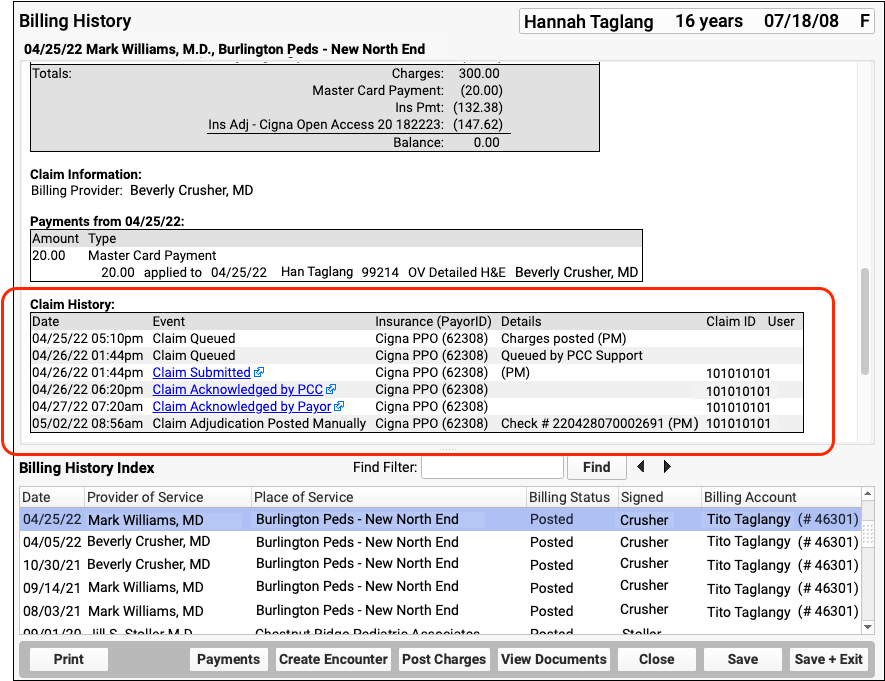

When you need to research an unpaid claim, open the Billing History in the patient’s chart. You can review the charges, payments, and claims for an encounter.

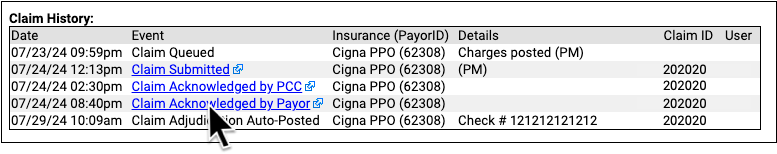

Use the Claim History component to review the lifecycle of all claims for the encounter, from submission to resolution. You can see when a claim was queued, held, delayed, processed, received by PCC’s clearinghouse, acknowledged by the payor, and more.

For each event, you can see the date, the event, and the insurance plan. When available in your system’s records, the component also displays: additional details, the claim ID, and the user who performed the action.

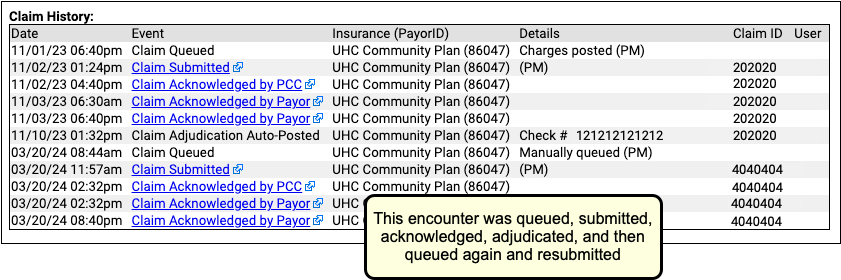

If an encounter was submitted multiple times, the claim history will show you each submission along with claim acknowledgements and other events.

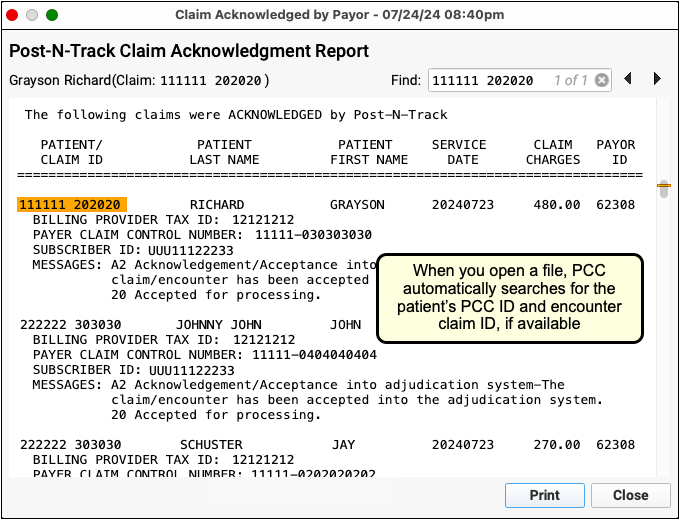

Read Acknowledgements and Other Responses to a Claim

When you need to dig deeper into a problem claim, you may want to review the claim submission log, acknowledgement, or other electronic response from a payor. When an electronic record is available for a claim event, you can click on a link to open it.

You can review the outgoing electronic claim file, claim acknowledgements, rejections, and most other responses for claims. (To review the ERA, use the Electronic Remittance Advice tool, as described above.)

Review Unpaid Balances with Advanced Reporting Tools

The steps above will ensure that you address all claims that had errors or that were rejected. And, when you review and post incoming ERAs, you can troubleshoot claim denials.

However, what if a problem was fixed, but a claim was never resubmitted? Or what if a claim issue occurred outside the range of a log or a report? How can you follow up on claims if the payer simply never responds? Insurance claims are not always paid, and insurance carriers do not always send you an explanation. Therefore, you may need other reports to track and work down your practice’s insurance A/R.

-

View an A/R Overview: Use the Insurance Company Aging Report (

insaging) report to get an overview of how major insurance groups are performing and to evaluate your total outstanding accounts receivable. -

Work on A/R, Claim-by-Claim: When you want to create a worklist of all unpaid, pending charges, use the Insurance Company Accounts Receivable (

inscoar) report to find unpaid charges that still pend an insurance payer.