Follow Up on Unpaid Encounters with Insurance Balances

How can you track your practice’s insurance A/R, know where your money is, and make sure payers respond to your claims? Use the Unpaid Encounters worklist in the Insurance Balances tool to follow up on unpaid claims.

Video: Watch Follow Up on Unpaid Encounters with Insurance Balances to learn more.

Contents

Open and Review the Unpaid Encounters Worklist

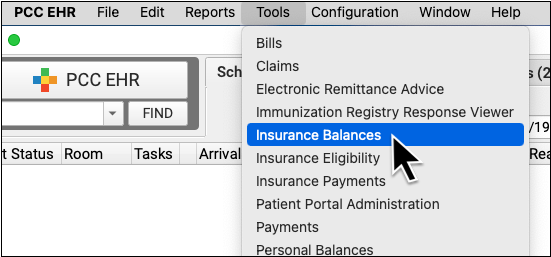

To review encounters with unpaid insurance balances, open the Insurance Balances tool and visit the Unpaid Encounters tab.

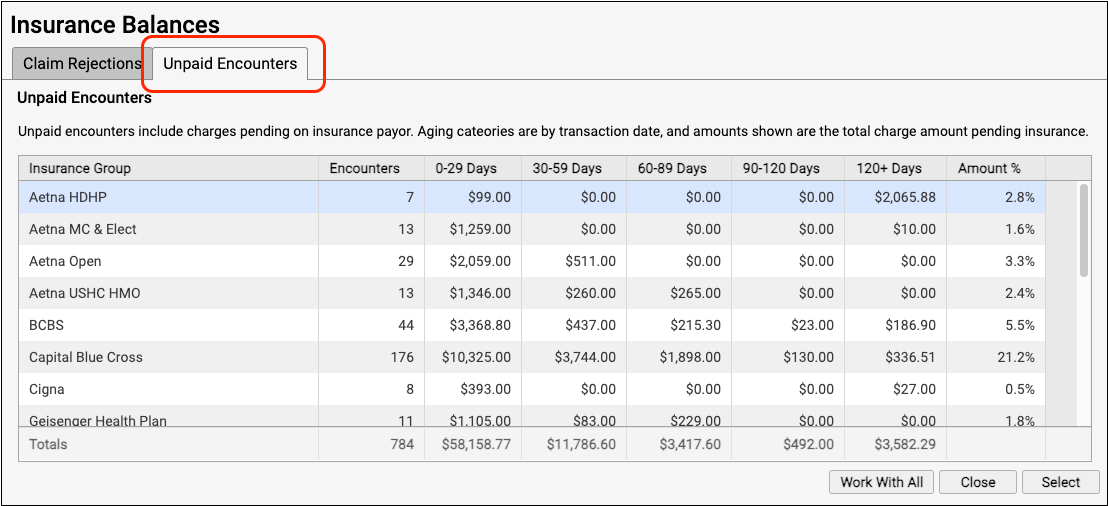

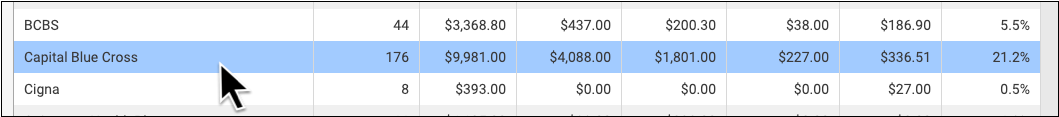

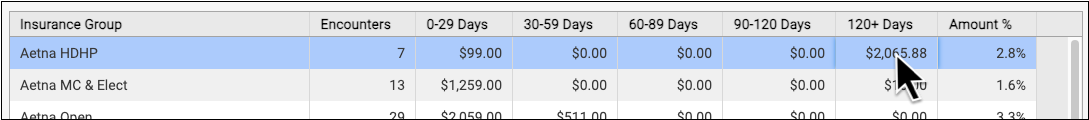

The Unpaid Encounters overview shows you total insurance balances, for each payor, aged from the date of service.

Double-click on a single insurance group or click "Work With All" to see unpaid encounters with charges pending insurance.

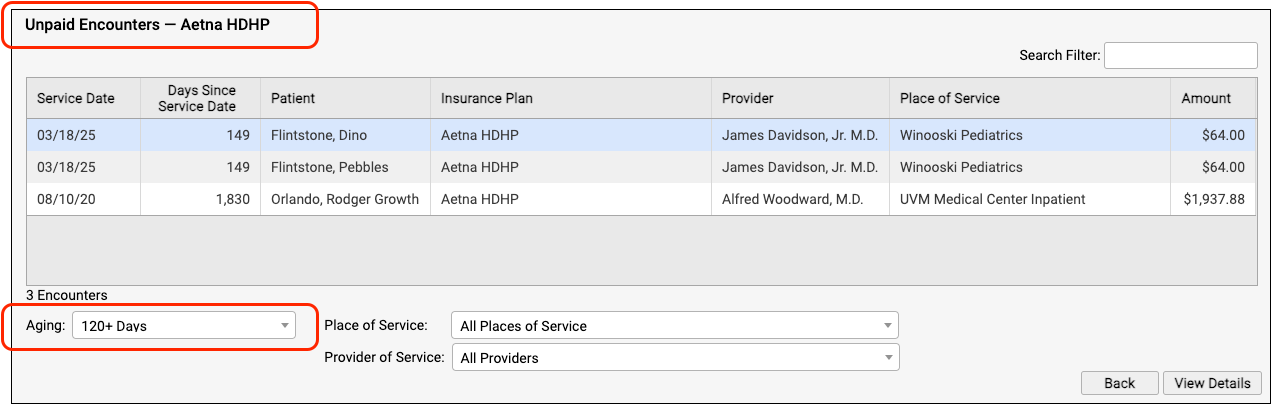

Jump to an Aging Category: You can optionally double-click on a specific aging category for a specific insurance group.

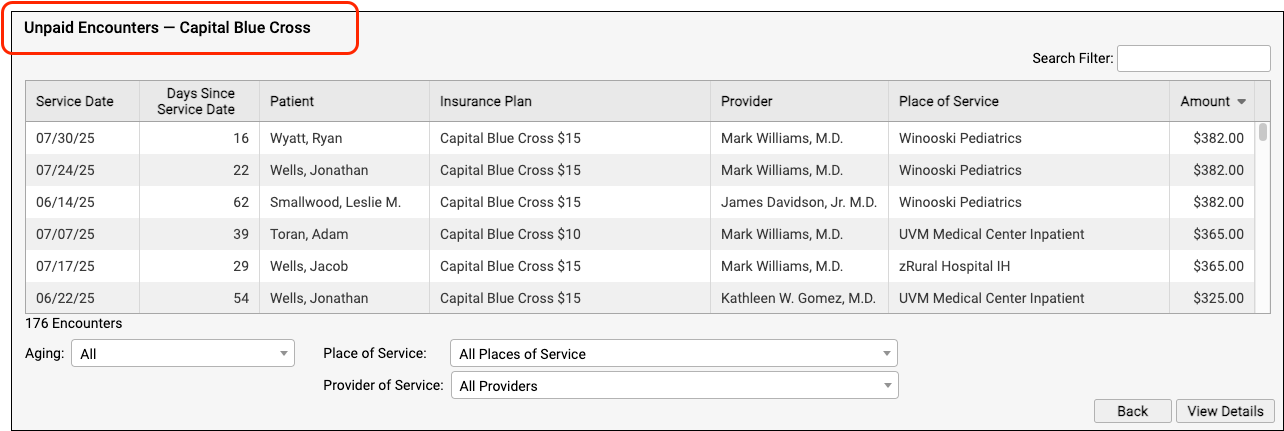

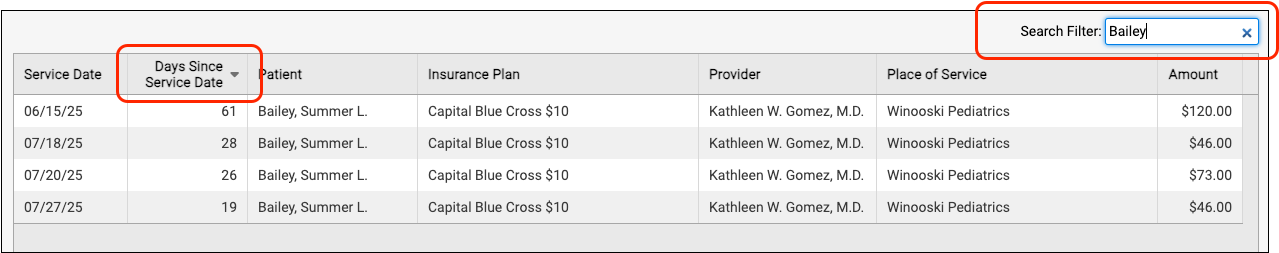

On the Unpaid Encounters worklist, you can see the date of service, the number of days since the date of service, the patient, the specific insurance plan, the provider of service, the place of service, and the amount due.

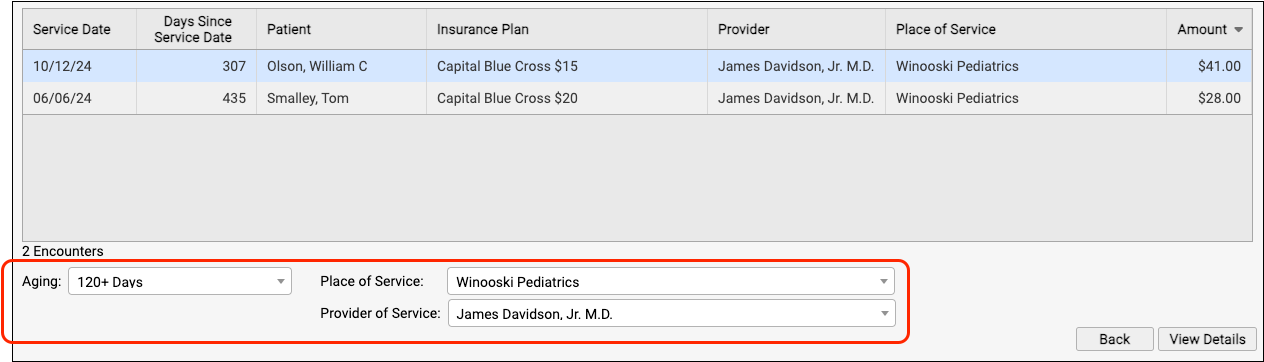

You can filter the list to isolate the specific unpaid claims that you need to work on. For example, you can select an aging category, a place of service, and/or a provider of service.

You can click on the header of any column to sort the encounters and use the Search field to filter the list down to a search term. By using these tools you can find specific groups of encounters or work down the list in a particular order.

By monitoring your practice's insurance A/R on the Unpaid Encounters worklist, you can stay on top of your receivables and ensure that no claims slip through the cracks.

Troubleshoot a Specific Encounter

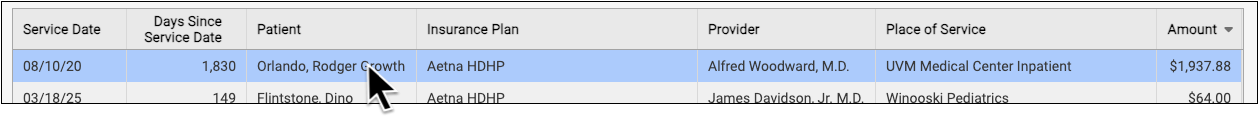

Double-click on an encounter to see more details.

The Unpaid Encounters – View Details screen provides information that will help you review and resolve billing issues with an encounter.

-

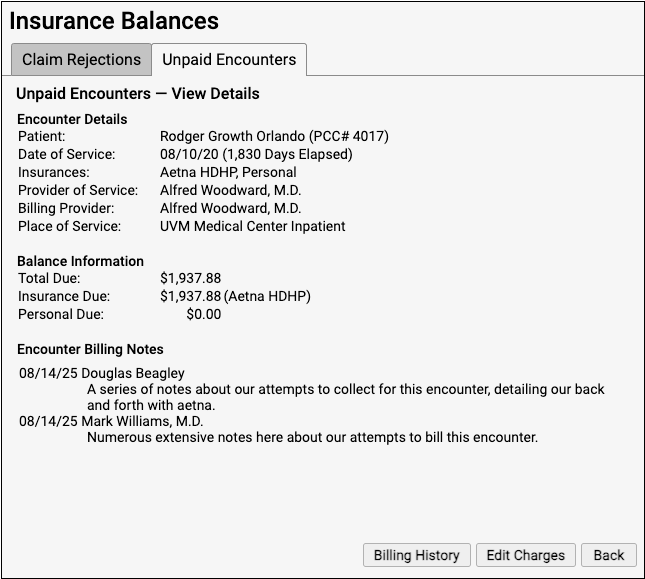

Encounter Details: The Encounter Details section summarizes basic billing information about the encounter, including both the Provider of Service and if an overriding “Billing Provider” was used on the claim.

-

Balance Information: The Balance Information section displays how much is outstanding for the encounter, how much is pending the payor, and how much is the family’s responsibility.

-

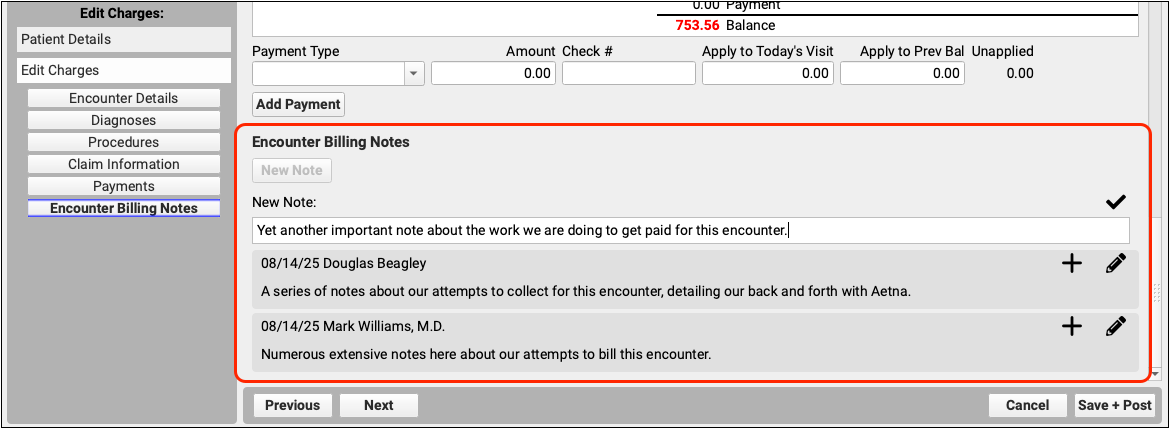

Encounter Billing Notes: If you or someone at your practice has entered encounter billing notes (sometimes called “visit billing notes” or “oops notes”), the Encounter Billing Notes section will display those notes. If you’ve contacted the payor and submitted a claim multiple times, you can review your practice’s notes to better understand the history of the rejection.

View More Encounter Details and the Encounter’s Claim History

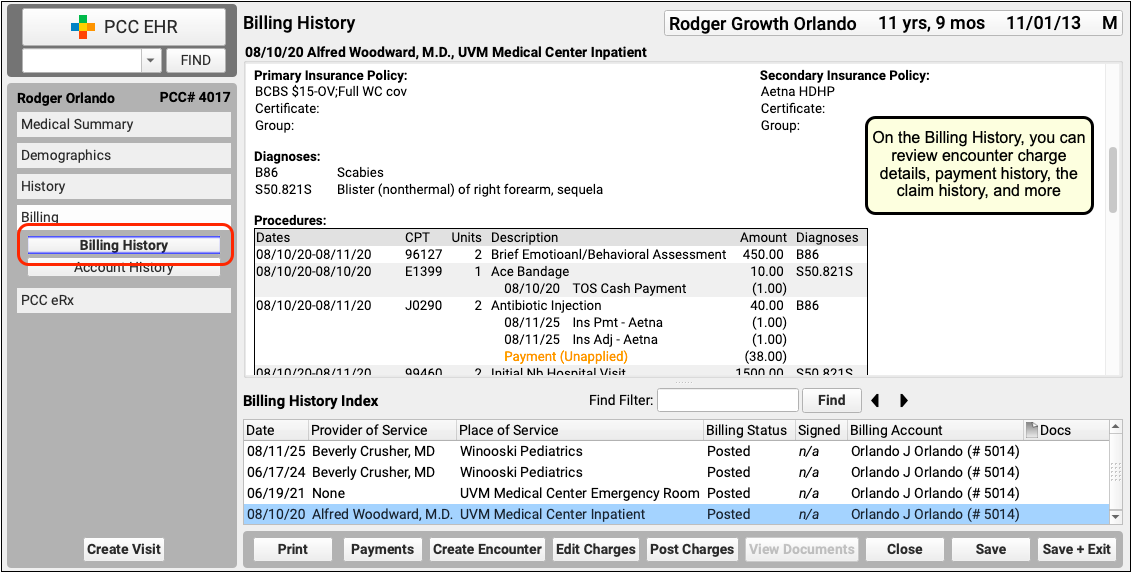

Did a claim go out? Has the payor responded? You may want to dig deeper and review charges, payments, and claim history for the encounter. Click “Billing History” to review more encounter details.

On the Billing History for the encounter, you can review full charge and payment details. The Claim History shows you all insurance billing activity and includes links to review the payor acknowledgements, posted ERAs, and more.

Review Patient Policies, the Complete Account History, and More

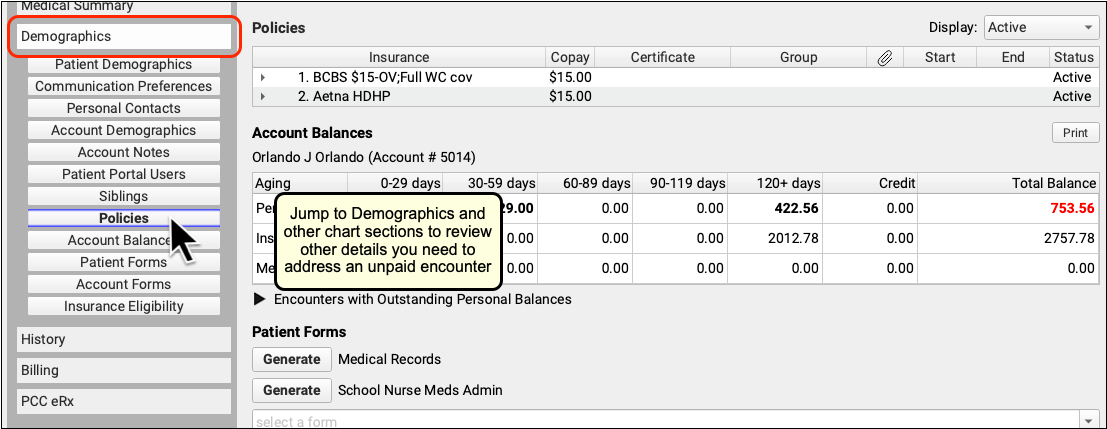

If you need to review more information about the patient and the account, you can navigate to other sections of the chart. For example, after clicking "Billing History", click "Demographics" to review insurance policies.

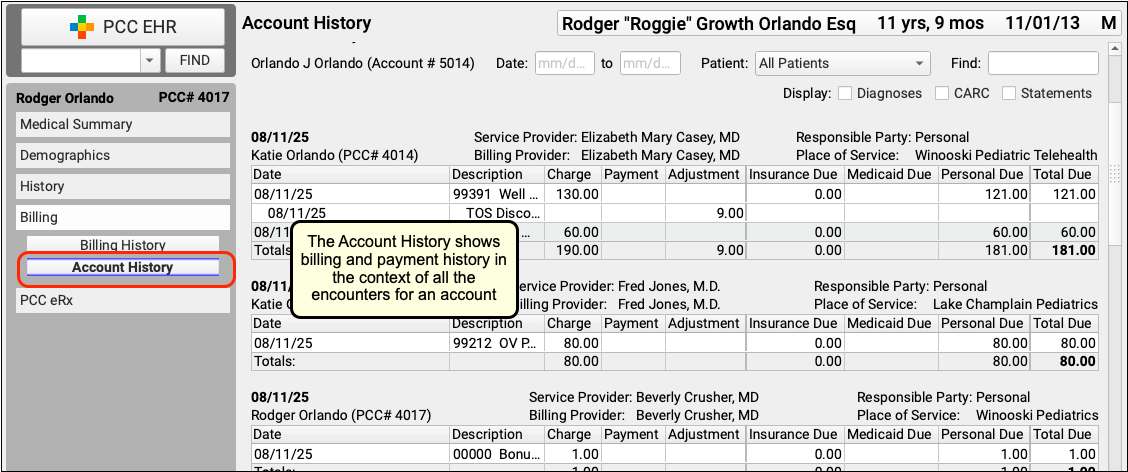

Or, to see the encounter and all financial transactions for the patient's billing account, visit the Account History.

By reviewing the full account history, you can see every event linked to each encounter and also understand the encounter in the context of the family's billing record.

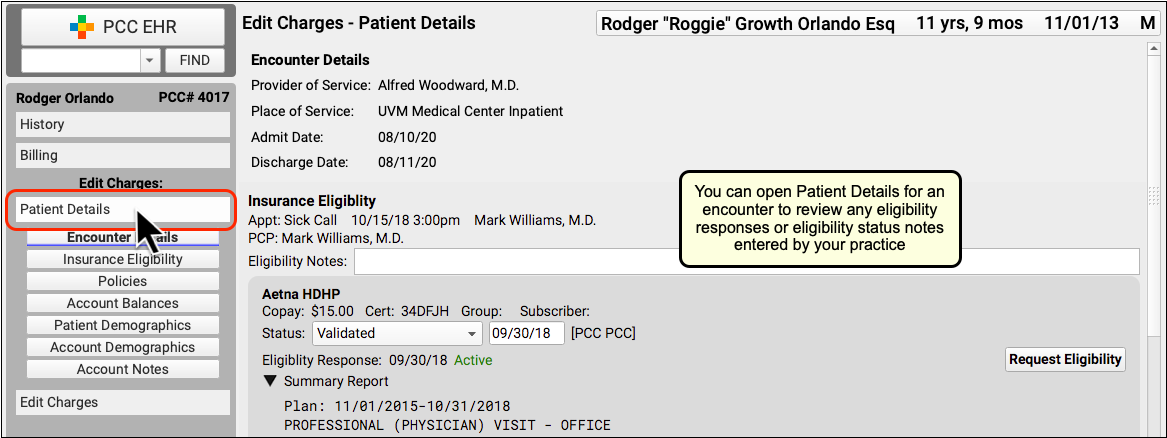

Review Eligibility for the Encounter's Date of Service

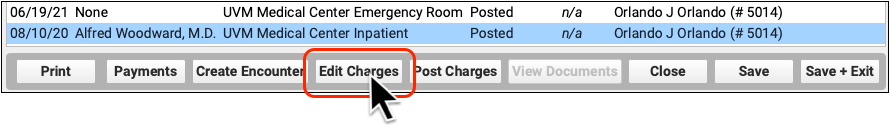

If you want to check if there are eligibility records for an encounter's date of service, click "Edit Charges" and then "Patient Details" to see the eligibility component for that encounter.

If your practice confirmed eligibility for the patient, either automatically or manually, you can review the results and any notes added at the time.

Edit Encounter Details and Submit a New Claim

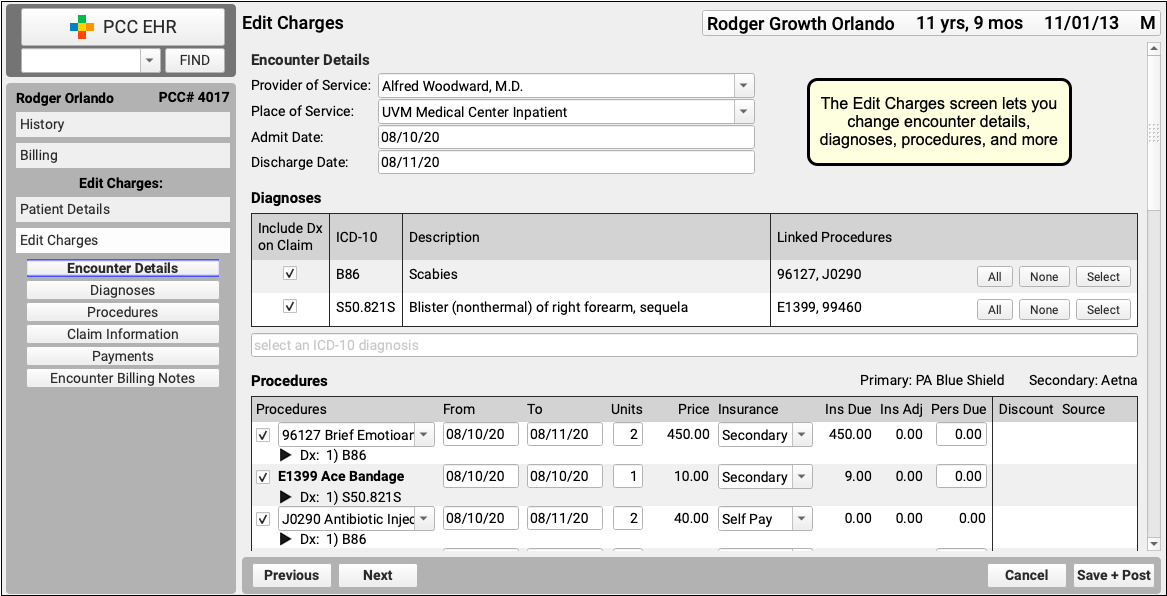

If you need to edit some aspect of the encounter and then optionally file a new claim, click "Edit Charges".

On the Edit Charges screen, you can change encounter details, diagnoses, procedures, and more.

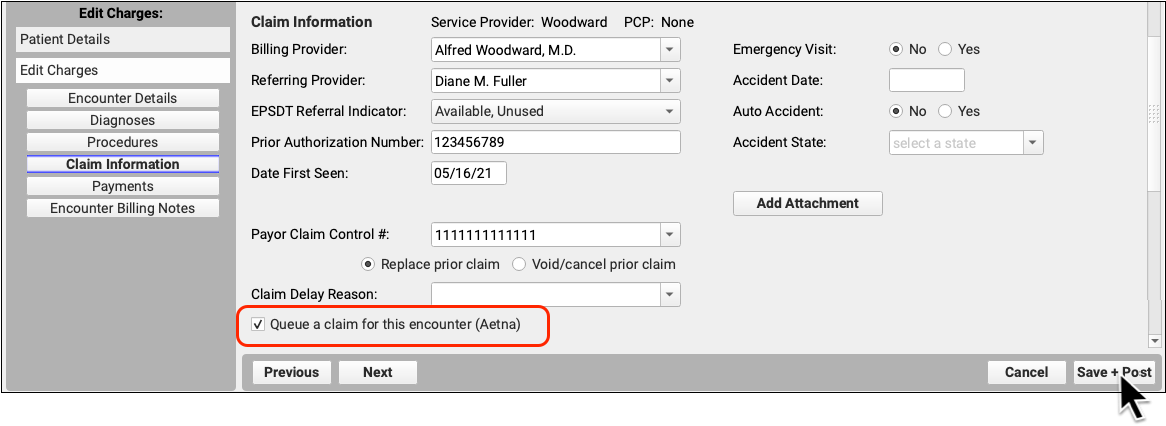

If you need to file a corrected claim, you can review and adjust the responsible party for each charge, enter claim information, and queue up a new claim.

On the same screen, you can use the Encounter Billing Notes component to add notes or indicate how an issue was resolved.

To learn more, read Edit Encounter Charges and Other Claim Information and Resubmit a Claim.