Work on Claim Errors, Rejections, and All Unpaid Claims

After you prepare and submit claims, how do you deal with stuck claims, rejections, claims with no response from the payor, and other unpaid encounters?

Read below for an overview of PCC’s tools for your insurance A/R workflow.

Contents

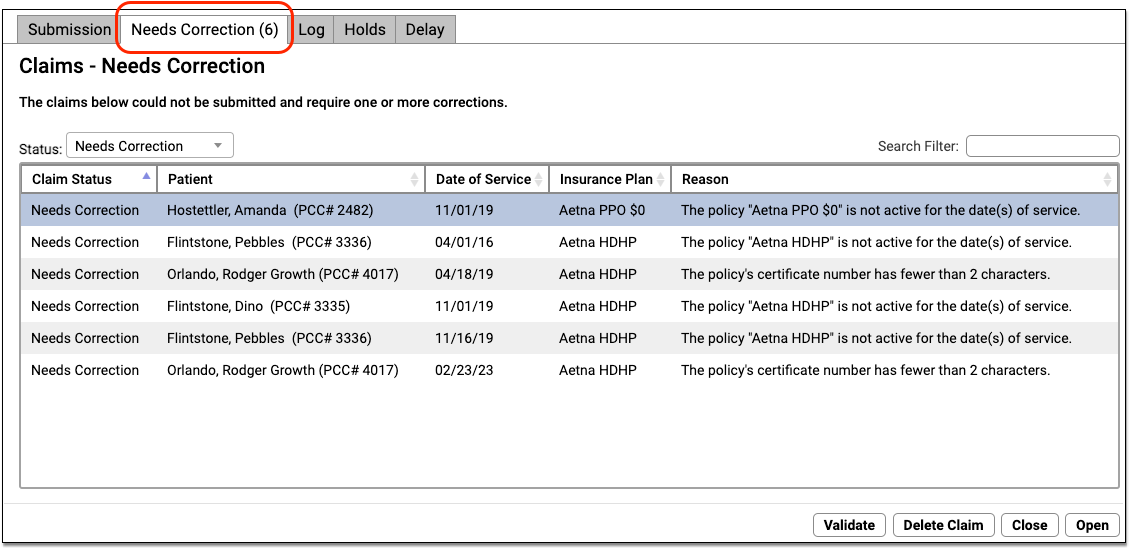

Fix Claims that Need Corrections

Your PCC system automatically catches many problems before a claim leaves your practice; it holds back claims that contain errors or otherwise need corrections.

After you prepare and submit claims, you can review all claims that need corrections.

You can work your way down the list, open each queued claim for more information, and use tools in the Claims tool to correct the issue. The claim will then go out when you next prepare and submit claims. Claims that needed corrections are also logged in the Log tab of the Claims tool.

For more information, read Submit Claims.

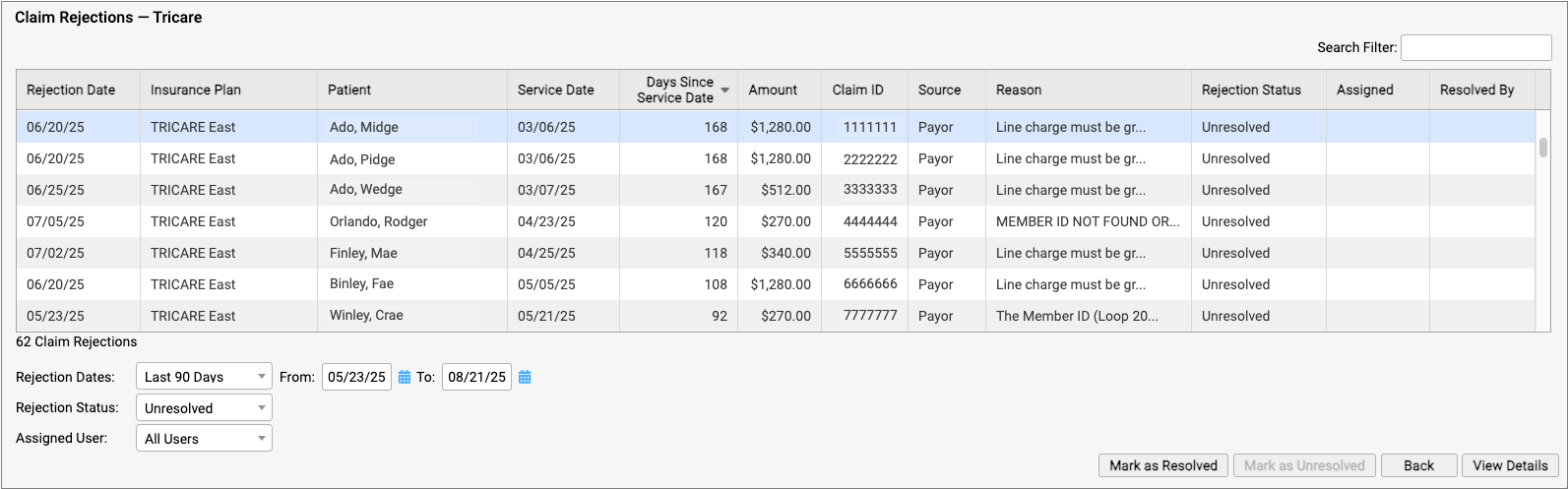

Respond to Every Claim Rejection

If unaddressed, rejected claims result in lost revenue. Use the Rejected Claims worklist to review and respond to every claim rejection sent to your practice.

To learn more, read Respond to Claim Rejections.

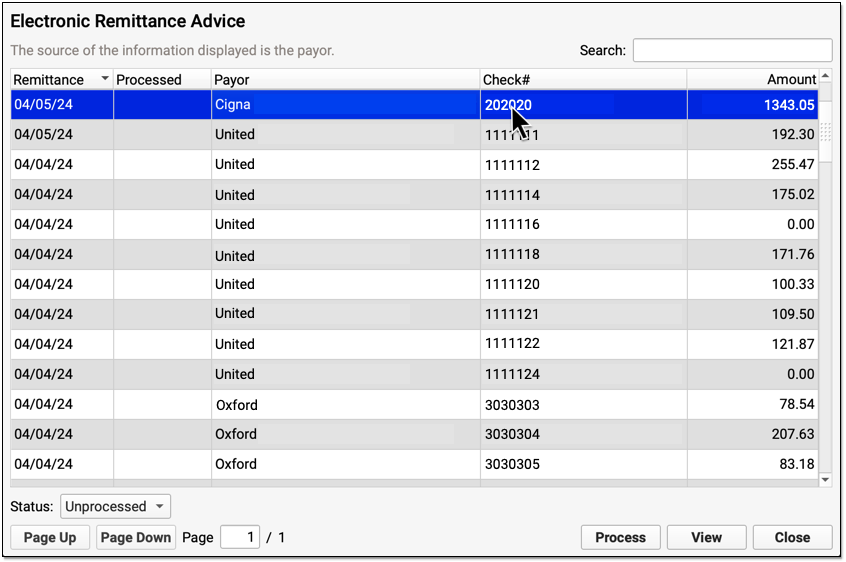

Read Electronic Remittance Advice From Payors

You can review all ERAs from payors in the Electronic Remittance Advice tool.

ERAs provide complete details about the payor’s adjudication, including payments, adjustments, denials, and unusual circumstances. Read the Read ERA 835s from Payors article to learn more.

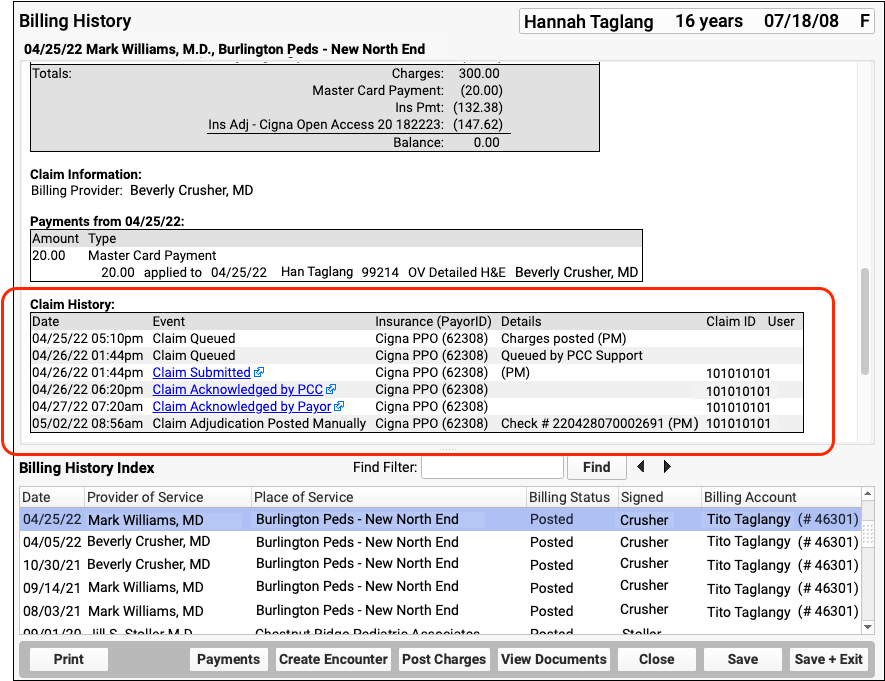

Review the Claim History of a Specific Encounter

When you need to understand when a claim was sent, acknowledged, rejected, paid, or resubmitted, use the Claim History found in the encounter’s Billing History.

The Claim History shows the lifecycle of all claims for the encounter, from submission to resolution. You can see when a claim was queued, held, delayed, processed, received by PCC’s clearinghouse, acknowledged by the payor, and more. By clicking on a link, you can read the payor’s original electronic response.

For more information, read Review an Encounter’s Billing History.

Followup on Unpaid Encounters with Insurance Balances

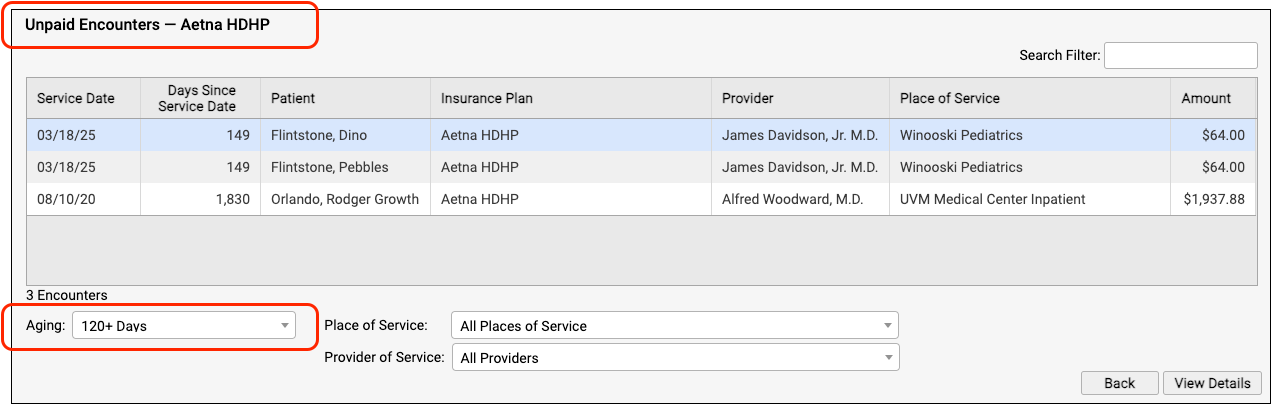

What if a problem was fixed, but a claim was never resubmitted? And how can you follow up on appeals, or on claims where the payor never responds? Use the Unpaid Encounters tab in the Insurance Balances tool to review an aged summary of your insurance A/R and an unpaid encounters worklist.

To learn more, read Follow Up on Unpaid Encounters with Insurance Balances.