Post Capitation Checks, Incentive Payments, Interest Payments, Overpayments, and Withhold Payments

How do you record a payment that does not correspond to amounts due for encounter charges?

When an insurance company sends you an ERA for encounter charges, PCC can post payments and adjustments automatically or you can record them manually (see Post Insurance Payments).

But what about capitation checks, incentive payments, insurance interest payments, payment amounts that exceed the amount due on a charge (“Overpayments”), and end-of-year withhold payments?

Use holding accounts to record these payments. Open the holding account, create an administrative encounter, and then select an adjustment procedure and enter the payment. Read the sections below to learn more.

Video: Watch Post Less-Common Payments to learn more.

Contents

Create Holding Accounts

For good reporting, payer analysis, and practice oversight, your practice should enter all payments into your practice’s financial records. PCC does not have a formal accounting entity for payments that are not attached to a patient. Instead, your practice can set up holding accounts for each type of payment you need to record.

The simplest way to do this is to create a patient record and a corresponding billing account using the name of the type of payment. For example, if you need to record end-of-year payments related to withholds, you could create patient and family records named “Withhold Withhold”, and post an adjustment and payment to that patient.

Create patients and accounts as you would for a normal family, using names for each type of payment you need to track. For example:

- Capitation Capitation

- Incentive Incentive

- Interest Interest

- Withhold Withhold

- Overpayments Overpayments

Many practices find it useful to be more specific and track these payments by insurance group. To do so, create holding accounts with the insurance group as the first name and the type of payment as the last name for the patient and the billing account. For example:

- BCBS Capitation

- BCBS Incentive

- BCBS Interest

- BCBS Withhold

- BCBS Overpayments

Your practice’s billers can decide what holding accounts you need and how to name them. If you use the insurance group name (or “Medicaid”) as the first name for the patient and account, it can make reviewing what happened and calculating total income from a payer easier later on. However, if you rarely receive one of these types of payments, you may decide instead to use a generic account and simply note the source of the income in an account note.

Post Capitation Checks, Incentive Payments, Interest Payments, Overpayments, and Withhold Payments

When you receive a payment in the form of a capitation check, incentive payment, insurance interest, overpayment, or withhold payment, follow the procedure below.

Open the Holding Account

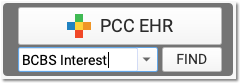

Open your practice's holding patient account named for the type of payment you need to post.

Your practice can set up holding accounts named for different kinds of payments and optionally include the name of a specific insurance group.

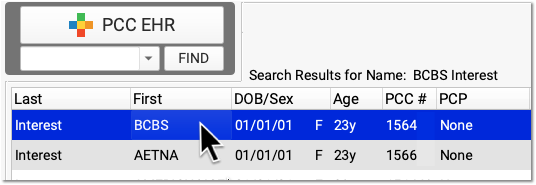

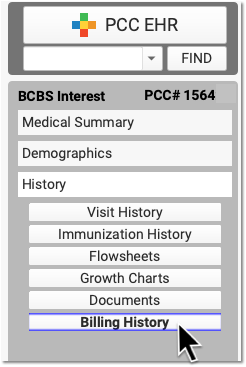

Navigate to the Billing History

Click on the History chart navigation button and then click Billing History.

Click Create Encounter

You can use the "Create Encounter" feature to record many different types of financial transactions, such as any fee not associated with an encounter or the less-common types of income described above.

Select a Provider and Optionally Update the Place of Service or Date

Select a provider for the administrative encounter. According to your practice's accounting practices, you may also need to adjust the place of service or date of service.

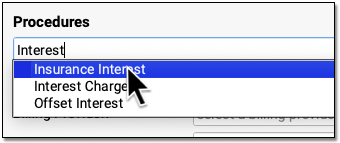

Select the Appropriate Adjustment Procedure and Enter an Amount

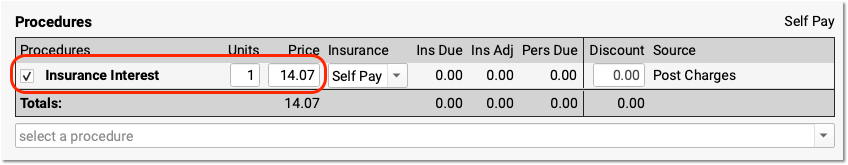

What is the payment for? In the Procedures section, find the adjustment procedure (such as "Insurance Interest") that will offset the payment you received. Enter the amount of the payment as the "Price" of this adjustment.

Self Pay: Whenever you enter an adjustment procedure to offset these types of payments on a holding account, you post the procedure as "Self Pay". Self Pay will be selected by default.

Enter Payment Details

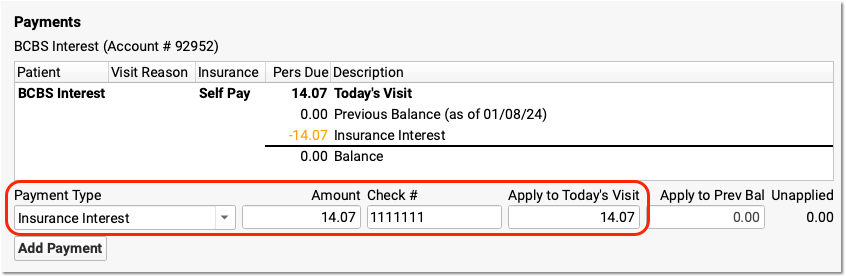

In the Payments section, select the Payment Type (such as "Insurance Interest"), and enter the amount and check number. The full amount of the payment should be applied to "today's visit".

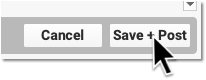

Click Save + Post

Click "Save + Post" to record the adjustment procedure and payment on the holding account.

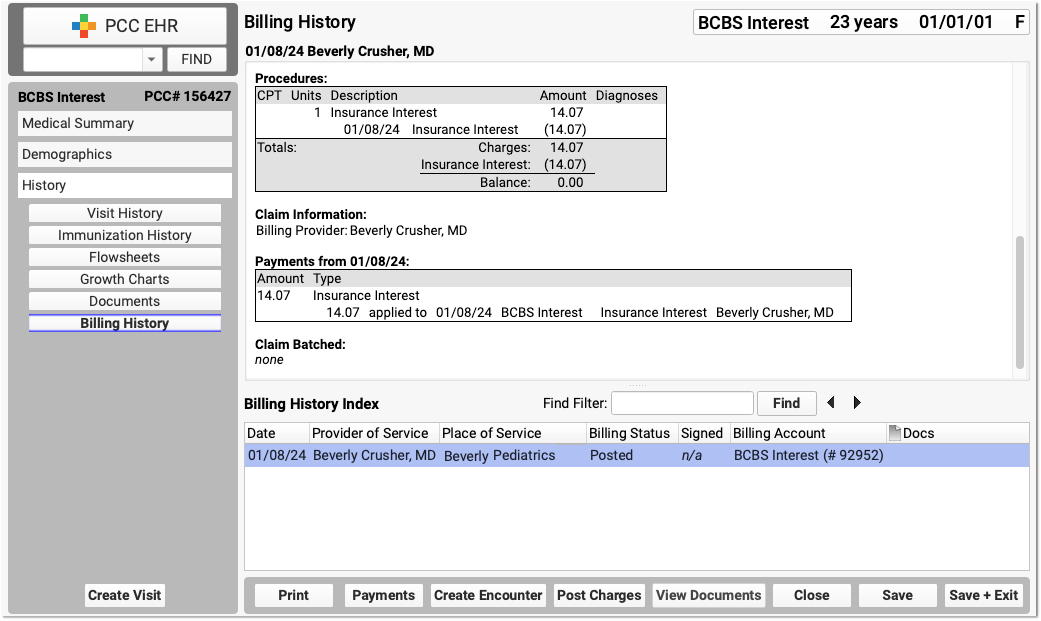

You can review what was posted on the Billing History and use the Billing History Index to review all payments posted to the account.

Special Considerations for Overpayments

You can record insurance overpayments in the same way as you record the other less-common payments, as shown in the procedure above. However, special circumstances may apply.

-

Record the Original Claim Information: An overpayment is typically not income, as payers often reclaim the overpayment at a later date. For that reason, when you record an overpayment on a holding account, you may want to record additional details such as the original account and date of service. Click the “Payments” button to visit the Payments tool and enter an account note in the Account Notes component.

-

Takeback or Reverse an Overpayment: PCC EHR’s Electronic Remittance Advice tool will autopost reversals for you. When you need to manually reverse an overpayment, click “Payments” to open the Payments tool. Then use the History tab to reverse the payment. To learn more, read Post a Returned Check or Other Payment Reversal.

-

Copay Amount Overpayments: If you are unable to post a payment for an encounter due to the wrong copay amount being due on a charge, you can change the copay amount when you enter the payment. You do not need to post the amount as an overpayment. See Post Insurance Payments.

Configure Adjustment Procedures and Payment Types on Your PCC System

When you record these less-common payment situations, you use adjustment procedures and payment types that reflect their purpose.

PCC Can Do This Configuration For You: Your PCC system is configured by default with adjustment procedures and payment types, and PCC Support can help you make changes as needed.

The adjustments and payment types are defined in your practice’s Procedures table and Payment Types tables, found in the Tables tool.

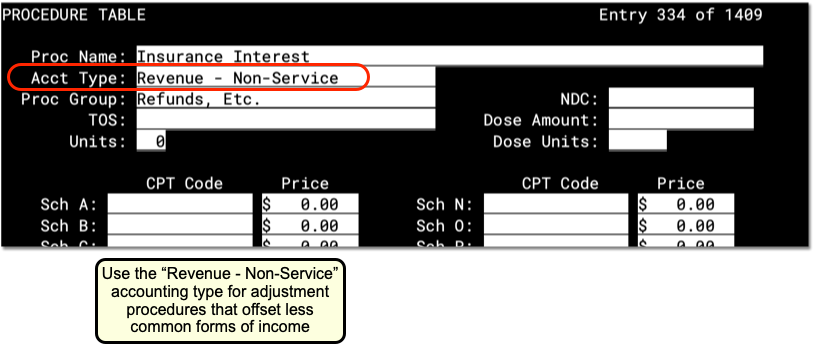

For example, when you post an insurance interest payment, it will be offset by a procedure called “Insurance Interest”, which indicates what the payment was for. These adjustment procedures are found in your Procedures table in the Tables tool. They have an accounting type of “Revenue – Non-Service” and have no billing code or price. (As shown in the procedure above, you enter the amount of the adjustment when you post it.)

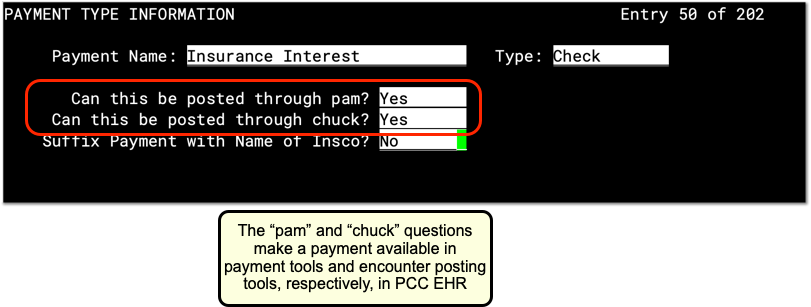

For each adjustment procedure, you use a corresponding payment type, such as an “Insurance Interest” payment type. Payment types are found in your Payment Types table in the Tables tool. Payments for insurance interest, capitation payments, and similar should have a Class of “Insurance” for reporting purposes. These payments types should include the option to be used when posting charges so they can be used when you create administrative encounters as shown in the procedure above.

To learn more about making changes to these tables, see Edit Your Practice’s Procedures and Adjustments and Edit Your Practice’s Configuration Tables.