Insurance Tables Reference

This article is a reference to the Insurance Companies table and the Insurance Groups table used in PCC software. You can edit both tables in the Table Editor (ted), found in the Practice Management interface in PCC EHR. Insurance tables contain information about the insurance plans on your PCC system, which are used for billing and reporting.

Watch a Video to Learn About Insurance Tables: You can learn more about your system’s insurance tables in the Add and Configure Insurance Plans to Your System video.

Introduction: What is an Insurance Table?

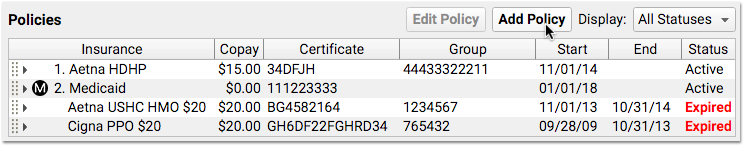

You can add a new policy to a patient’s record quickly and easily with the Policies component in PCC EHR. (The functionality is mirrored in PCC’s Partner billing system.)

However, when you add a new policy, what master list of insurance plans do you search from?

Your practice has a custom list of the insurance plans that you bill. That list is kept in the Insurance Companies table in the Table Editor (ted).

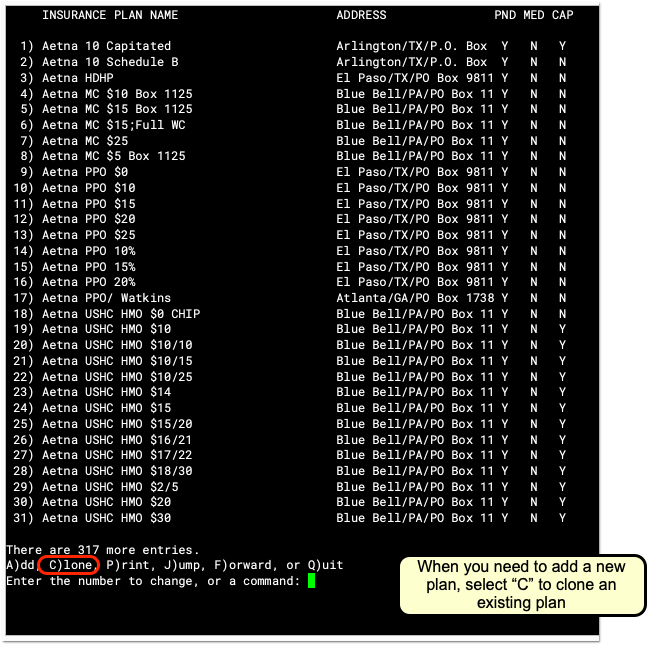

Insurance Companies

The Insurance Companies table has a separate entry for every plan on your system, typically with multiple policy examples reflecting different copay agreements.

Insurance Table Columns

Here are the columns and what each one indicates:

| Column Label: | Description: |

|---|---|

| INSURANCE PLAN NAME | Full name of the insurance company plan/carrier |

| ADDRESS | Address of the plan, useful for differentiating plans with the same name |

| PND | Do charges pend this insurance company by default? |

| MED | Is this a MEDICAID type plan? |

| CAP | Is this plan CAPITATED by default? |

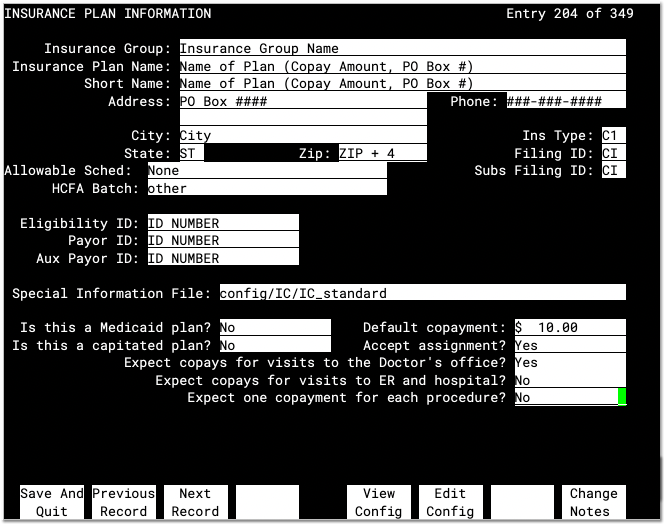

Insurance Plan Field Reference

When you add a plan to your system, you can either type A to add a new plan from scratch or type C to clone an existing insurance plan. Even if you plan to make major changes, PCC recommends you use the “Clone” feature. This will ensure that every required field is filled out.

Whether you are adding, cloning, or reviewing an insurance plan, you will see a screen with details about the plan. Fill in each field as described below and press Enter to move from field to field.

After you make changes to an insurance plan, press F1 – Save and Quit or press Page Down or Page Up to save your work.

Insurance Group

Your practice has a custom list of Insurance Groups, and you can assign each plan to a group. Groups are used for various financial reports only and do not affect claims, contract fee schedules, or billing behaviors for procedures. You can use the asterisk (*) in this field to see your list of Insurance Groups.

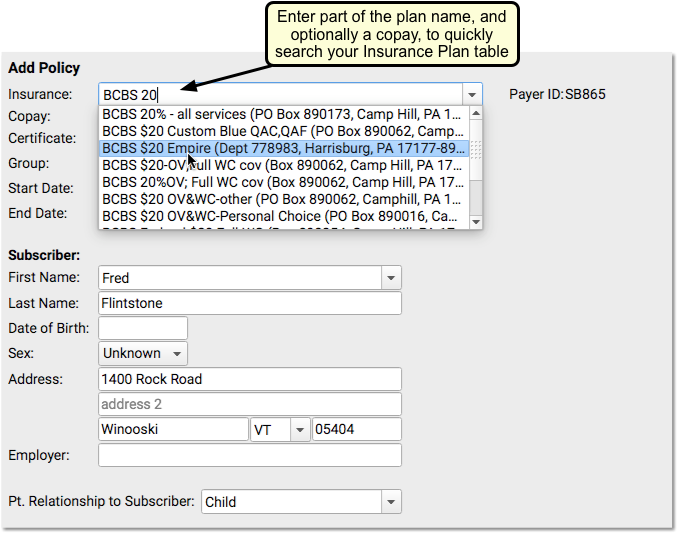

Insurance Plan Name

The Insurance Plan Name is how the insurance plan will appear on lists and in a patient’s policy record. Practices typically include the expected default copay amount in the plan name, which makes it easier to select the correct plan when adding a patient’s policy. Some offices also include the PO Box used for claim submission to help make it easier to select the correct plan quickly.

Short Name

An abbreviated name for the insurance plan. It is used when displaying the plan name in various places. Typically, the short name matches the Insurance Plan Name or is an abbreviated version.

Address, City, State, and Zip

The mailing address that would appear on paper claims.

Allowable Schedule

The short name of the contract fee schedule used for this payer. If your practice enters your contract fee schedules into PCC, you can automatically pull claims that fail to meet the schedule and then followup with the payer. For more information, see Configure Contract Fee Schedules (allowables).

HCFA Batch

The batch that controls claim grouping and formatting for this plan. Individual plans are grouped into batches for the purpose of generating similar claims. You can use the asterisk (*) to see a list of claim batches on your system. The HCFA batch that claims are grouped into has no connection to the Insurance Group field.

All Insurance Plans Need a Batch: This field should never be empty. It controls the formatting of your claims for the payer. If you believe you need to add a new batch, contact PCC and an EDI specialist will assist you.

Payor ID

The identification number used for electronic claim submissions to this plan. Insurance plans from the same company generally share the same Payer ID number.

Where Do I Find an Insurance Plan's Payer or Payor ID?: If you cloned an existing insurance plan of the same company, the payer ID number may already be correct. Otherwise, the ID might appear on the insurance card. If the payer ID does not appear on the card, there may be a phone number on the card hat you can call to determine the correct payer ID for claims. You can also talk to PCC Support for help tracking down the ID.

Ins Type, Filing ID, Subs Filing ID, Eligibility ID, Aux Payor ID

Do not change the text in these fields. These fields are used in special circumstances for claim submission. They were added in the early 2000s due to HIPAA changes to claim submission formats. You can ignore these fields unless directed by PCC. By default, they should list “C1” for Insurance Type and and “CI” for Filing ID and Subsequent Filing ID.

Special Information File

This field contains a file path to the insurance plan’s Special Information file, also called an ibar file or I_file.

PCC Support will adjust this field and the underlying file as needed.

When you post charges, PCC checks these files for special behaviors, overriding other settings for the insurance plan. For example, the Special Information file can define whether a certain procedure should pend the insurance plan at all, appear on claims, capitate, use a special price schedule (rare, as insurance contracts generally disallow this), or write off an amount or percentage of the procedure’s price. Additionally, the Special Information file defines what copay should be charged for each procedure, overriding the Default Copay field for the plan.

All Insurance Plans Should Have a Special Information File: As a best practice, every plan should have a Special Information file. PCC’s charge posting and claim processing will use the default answers for the plan otherwise, which will still function correctly in most cases, but PCC’s standard Special Information file improves how copays and other issues are handled. If you created a new insurance plan entry by cloning an existing plan, then this field is probably filled out appropriately already. Otherwise, you can use the asterisk (*) to see a list of ibar files on your system and select IC_standard.

Is this a Medicaid plan?

A Yes/No question that determines whether this plan will behave like a medicaid plan. If set to “Yes,” then:

- The plan will always be sorted below non-Medicaid insurance policies when a patient has multiple coverage. (If a patient has more than one insurance policy, Medicaid policies will be secondary or tertiary.) If this plan ever needs to be the primary plan in front of private insurance, you should not set the plan to be a Medicaid plan.

- Charges pending the plan will appear with an asterisk (*) in the Correct Mistakes (oops) program, signaling your practice’s billers that the charges are Medicaid charges.

- PCC Dashboards will consider the plan, and any other plans in the same insurance group, to be Medicaid-type plans for reporting purposes.

Is this a capitated plan?

A Yes/No question that sets the default capitation behavior for this plan. If set to “Yes,” then charges posted to this plan will be adjusted off at the time of service. However, the Special Information File can overrule this question and configure the specific desired adjustment behavior for all procedures. PCC Support helps set up and configure adjustment behaviors for insurance plans that need this behavior.

Default copayment

The default expected copay amount for this plan. You should enter this information in the name of the plan as well, so that selecting the plan will be easy for your staff. The Special Information File can overrule how much copay to charge for each procedure.

If your new plan has different copay amounts for different types of procedures, put the most common or default copay in this field. The Special Information File can be configured to automatically set the copay for each procedure.

Accept Assignment

A Yes/No question that turns default pending behavior for this plan on and off. If this plan does not accept assignment, then charges posted to it will remain the personal responsibility of the guarantor/Bill Payer and will not generate claims. However, the Special Information File overrides this setting and determines precisely which procedures will pend to the insurance company. This question also determines a value that is sent on claims.

Copay Questions

A series of Yes/No questions that determine default copay behavior for this insurance plan.

- Expect copays for visits to the Doctor’s office?

- Expect copays for visits to ER and hospital?

- Expect one copayment for each procedure?

Use these questions to define default copay expectations. The first question should usually be set to yes, as it assigns a copay for a visit to the doctor’s office. The second question defines whether a copay should be charged for hospital visits. The final question sets one copay for every procedure. When posting charges, PCC checks these questions and then checks the Special Information File. The Special Information file typically overrides these questions and defines precise copay expectations for each procedure.

Change Insurance Notes

If you want to enter specific notes relating to this plan, you can press F8 – Change Notes. The notes you add will be visible in the Policies component in PCC EHR, the Patient Insurance Policies screen in Practice Management, and will appear when you post charges for a patient with this insurance plan.

After you make changes to an insurance plan, press F1 – Save and Quit or press Page Down or Page Up to save your work.

Insurance Groups and the Insurance Groups Table

The Insurance Groups table, also located in the Table Editor (ted), lists your practice’s customizable groups used for reporting. All insurance plans in the Insurance Companies table have an assigned Insurance Group.

Insurance Groups have a name, an order number (used for determining how they appear in reports), and a “Tot?” signifier, indicating whether or not charges and payments for policies in each group should be included in reporting totals.

If you wish to break out reporting for a subset of an insurance group, you can clone an existing group, and enter a new name. Then you can assign the correct group to corresponding insurance plans.