ERAs and EOBs with PCC

After a payor reviews your electronic claim, they will send your practice an explanation of what charges are paid, adjusted, or denied.

- On paper, this information arrives as an Explanation of Benefits (EOB) and a check.

- The electronic version of an EOB is called an Electronic Remittance Advice, or ERA. An ERA usually arrives in coordination with a direct deposit to your practice’s bank account.

You can use PCC software to post payment and adjustment information from both ERAs and traditional EOBs.

Video: Watch Read ERA 835s from Payors and Autopost ERAs in PCC EHR to learn more.

Contents

- 1 How Do I Get Signed Up for ERAs with Carriers?

- 2 When Will I Autopost ERAs, and When Will I Manually Post Payments and Adjustments?

- 3 When My PCC System Receives ERAs and EOBs, How Do I Review and Post Them?

- 4 What Sort of Responses Can PCC Automatically Post from Incoming ERAs, and What Will Need My Direct Attention?

- 5 View CARC, RARC and CORE Business Scenarios on ERAs

How Do I Get Signed Up for ERAs with Carriers?

Your PCC system can automatically receive ERAs from most payors and claim clearinghouses. Some insurance carriers require special registration steps to sign up to receive ERAs. Since an ERA interface is usually required to receive payments electronically and to use PCC’s autoposting features, you should sign up for ERA with as many of your major carriers as you can.

- Contact PCC Support for help determining your biggest payors and to find out how to sign up for ERA.

- Or, contact PCC Support about a specific payor, and we will begin the setup process. It is helpful if you include your name, contact and practice information, and the insurance payor’s national identification number (the “payor ID”).

ERAs and Other Electronic Claim Communication is Part of Your PCC Comprehensive Care Plan: ERA connections, as with electronic claims and other forms of electronic data exchange, are services included with your Comprehensive Care Plan with PCC.

When Will I Autopost ERAs, and When Will I Manually Post Payments and Adjustments?

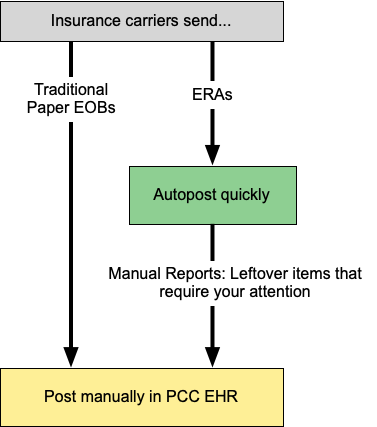

If you receive only a paper EOB, you can post the adjudication manually. If you receive an ERA, you can automatically post the adjudication against the charge records on your system.

While autoposting, PCC EHR checks for errors or problems that may require your intervention. You can review those issues and post payments and adjustments manually.

At any time, you can also print out any ERA from the Electronic Remittance Advice tool.

When My PCC System Receives ERAs and EOBs, How Do I Review and Post Them?

You can learn how to post ERAs and EOBs by reviewing the following:

You can learn more about how to read ERAs and research adjudication responses from payors here:

PCC Support can also train you and your practice billing staff on how to generate and send claims, post payments, and follow up on outstanding balances. Contact us at any time for help.

What Sort of Responses Can PCC Automatically Post from Incoming ERAs, and What Will Need My Direct Attention?

You can autopost almost all payments and adjustments from ERAs from participating carriers. PCC EHR automatically handles most situations, including changes in expected copay and reversals that appear on an ERA.

To learn how PCC EHR handles specific situations, and review a reference of what items on an ERA can not be posted automatically see:

View CARC, RARC and CORE Business Scenarios on ERAs

When you review ERAs, you will see a full explanation of the payor’s response. ERAs include CARC and RARC codes, and PCC also identifies CORE Business Scenarios and displays information about them. These details can help you understand the payor’s adjudication. For more information, see Read 835s from Payors.

What is a Business Scenario?: Insurance payors add CARCs (Claim Adjustment Reason Codes) to your EOBs and ERAs to explain payments and adjustments. There are hundreds of CARCs. Affordable Care Act regulations group these codes into four “Business Scenarios” which use everyday language to clarify CARCs. When you view ERAs in PCC, you may see CARC codes and their associated CORE Business Scenarios.