How to Report on Your Practice’s Use of Provider Relief Funds

Contents

If your practice received Provider Relief Fund payments of over $10,000 between July 1st, 2020 and December 31st, 2020, you may need to report on the use of these funds before March 31st, 2022. This is the “Reporting Period 2” requirement from the HRSA. These payments were part of the CARES Act and subsequent relief programs during the COVID-19 pandemic.

For later rounds of funding, you may need to update numbers and verify your practice’s loss of income.

What Numbers Do You Need In Order to Report Your Use of PRF Funds?

How do you report on how your Provider Relief Fund payments were used? For most practices, this money is applied towards “patient care lost revenues.”

From the HRSA:

When reporting lost revenues, providers do not need to account for a specific expense to ‘use’ funding by the deadline. Instead, they need to be able to document that the loss occurred during the relevant time period.

(https://www.hrsa.gov/sites/default/files/hrsa/provider-relief/prf-lost-revenues-guide-rp2.pdf)

PCC has worked with several pediatric practices who are reporting their lost revenue. On the HRSA’s reporting website, they are typically asked to enter “Total Revenue/Net Charges from Patient Care” for each quarter from 2019 through the end of 2021. The HRSA’s tool asks practices for the total amounts from Medicare, Medicaid, Self Pay, and Private Insurance payments.

How Do You Get Quarterly Payment Totals from Your PCC System?

There are many different PCC report tools that can produce quarterly revenue amounts, and you may have already worked with PCC to create visit-based payment reports, daysheet-style reports, and similar. You might retrieve income amounts from your practice’s accounting software.

After learning more about this need in early 2022, PCC created a custom “Quarterly Charges and Payments By Insurance Group” report, which is available on your PCC system as of Thursday, March 24th.

What Income Should Be Included?: When you run this report, or another PCC report or retrieve information from your accounting software, your practice should consider what income to include. The HRSA indicates you should report revenue from patient care, which includes: fee-for-service insurance payments, capitation insurance payments, value-based payments (P4P and bonus money), patient payments/copayments and money from the COVID Uninsured Fund and CAF Fund. Patient care revenue does not include the PRF funds themselves, PPP loans, and other non-patient care revenue such as Meaningful Use money or interest income. If your practice enters non-patient care revenue sources of income into your PCC system, then you should use report criteria to exclude that income. See the example in the procedure below. For more information, see PRF Reporting / Keeping Your Funds.

Follow this procedure to calculate your total quarterly payments for reporting your lost revenue.

Open the Practice Management Window

Click on the Practice Management icon to open PCC’s under-the-hood Practice Management tool.

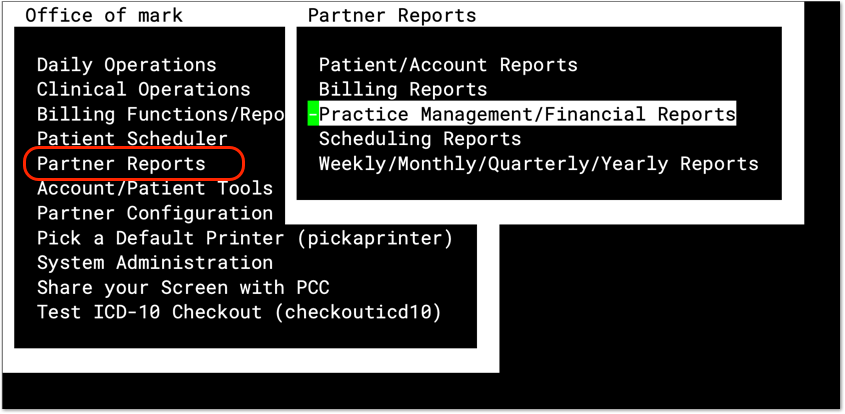

Open the Smart Report Suite

In the Partner Reports–>Practice Management/Financial Reports window, open the Smart Report Suite.

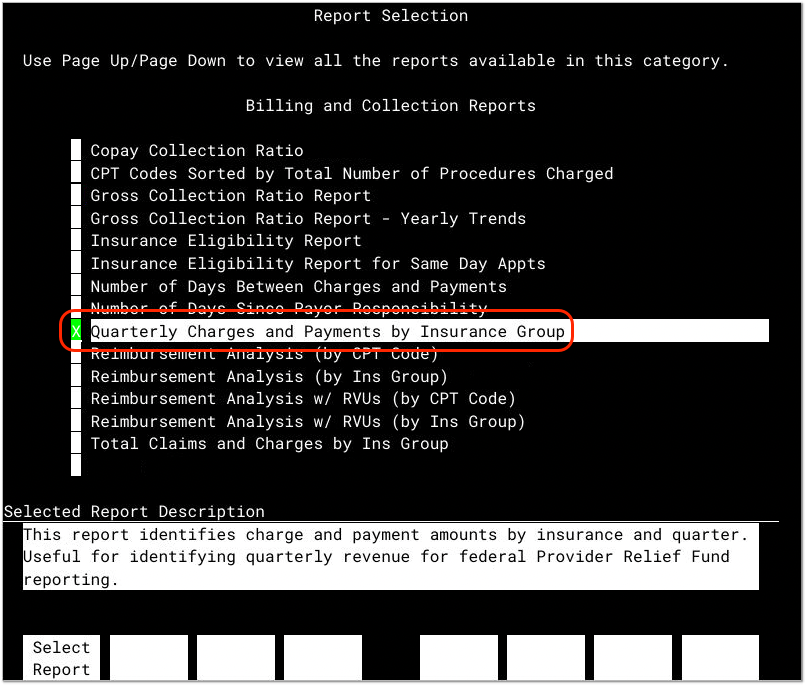

Run the Quarterly Charges and Payments by Insurance Group Report

In the Billing and Collection Reports section, open the Quarterly Charges and Payments by Insurance Group report.

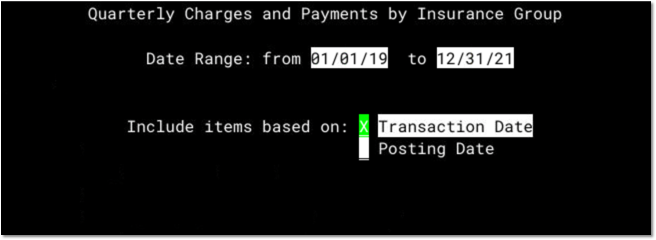

Enter a Date Range

Enter a Date Range. For Reporting Period 2 for Provider Relief Funds received during the COVID-19 pandemic, enter 1/1/2019 through 12/31/2021.

Press F1 to continue.

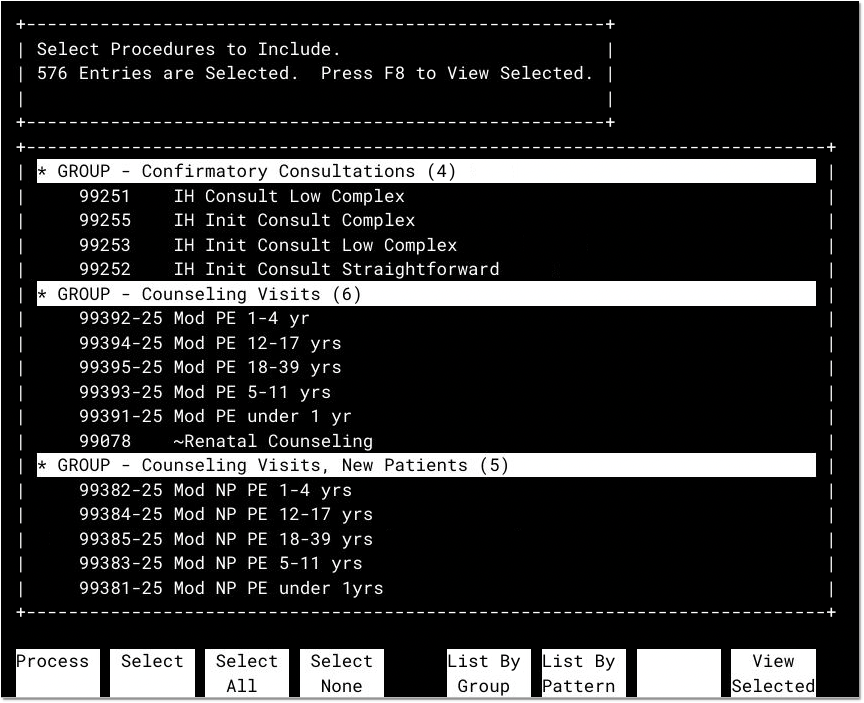

Select Procedures that Relate to Revenue for Patient Care

The report will next ask you to select procedures to include on the report. You should select all procedures that are patient revenue.

For example, you could select all procedures by group, and then deselect the Refund procedure group.

If your practice uses procedures to offset and post the PRF funds, or other sources of income that are not patient revenue, you can deselect those procedures. They should not be used when reporting your revenue loss for PRF funds.

After you adjust your procedure selection, press F1 to continue.

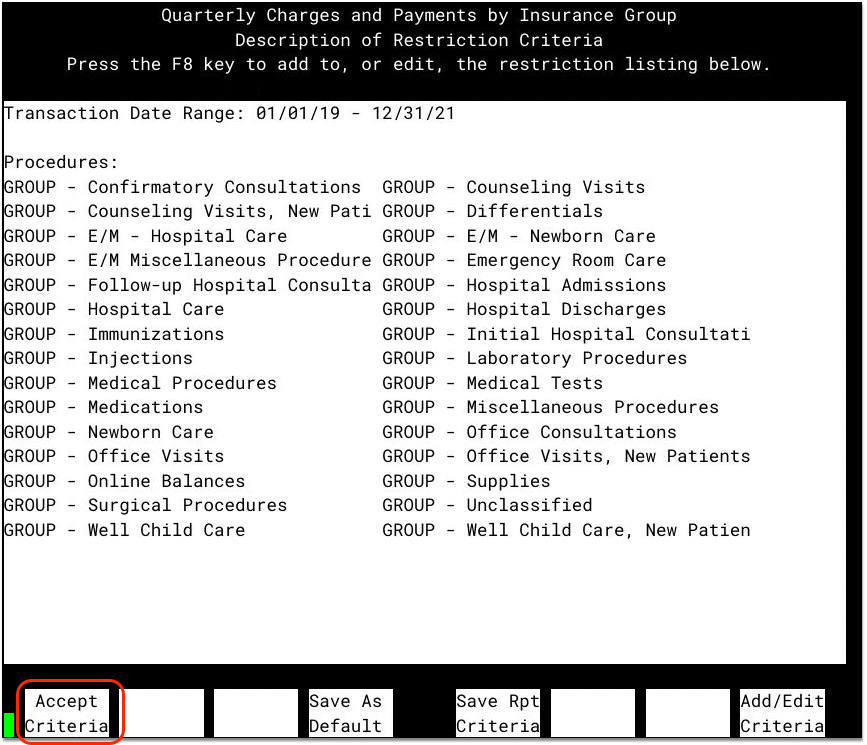

Confirm Criteria

On the next screen, press F1 to confirm the report criteria.

You can optionally adjust criteria for specific reporting needs at your practice. For example, you could filter by provider or location.

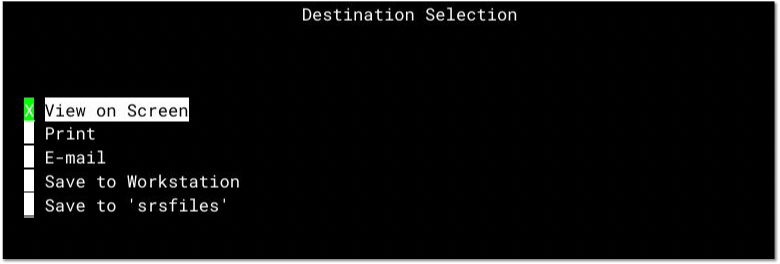

Select Destination and Review Results

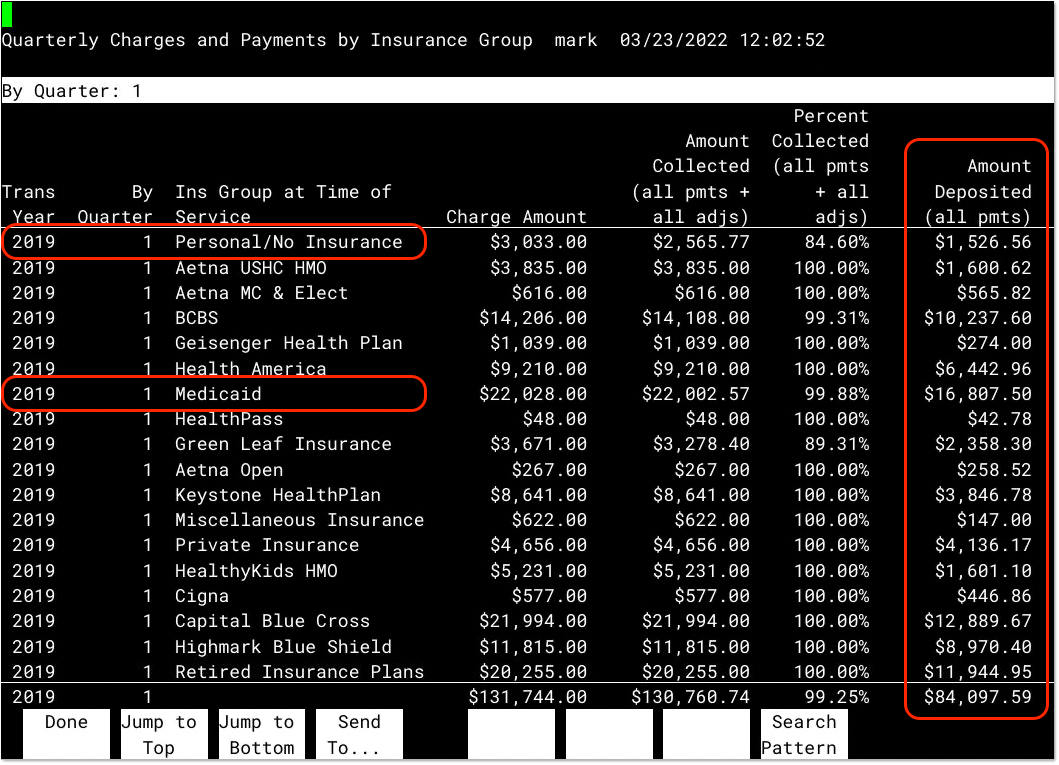

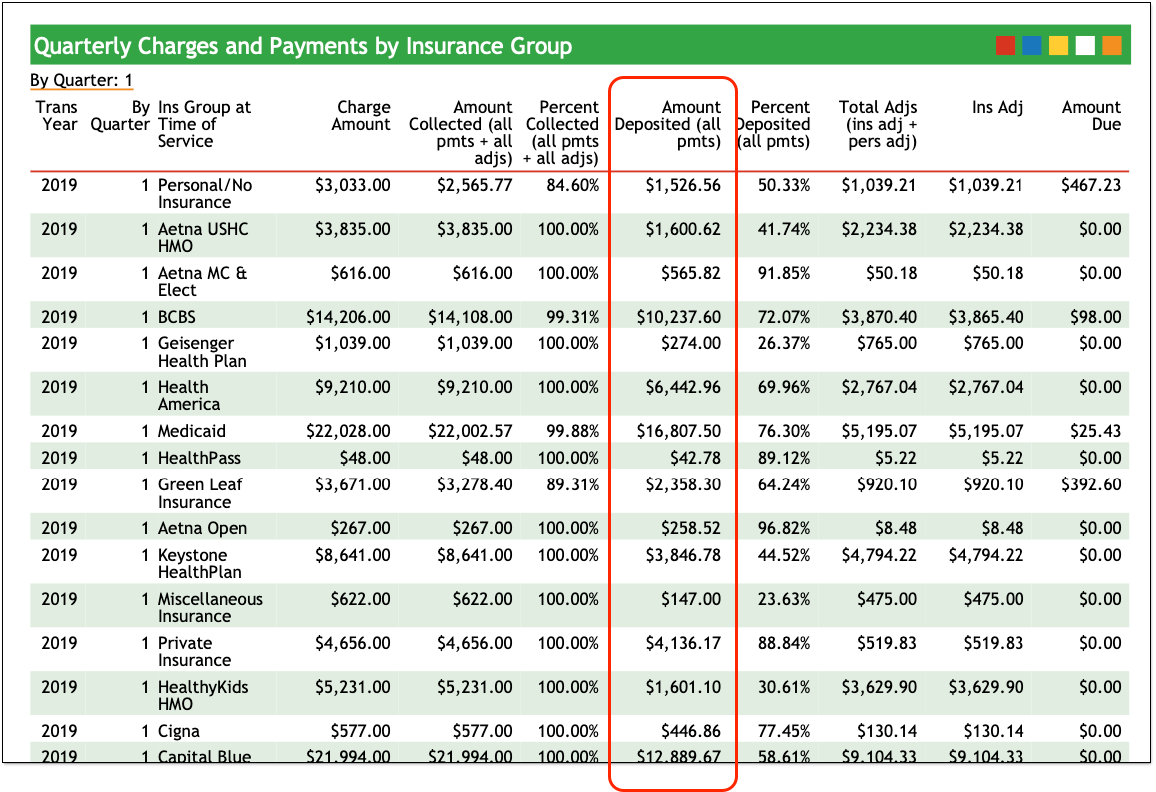

For each insurance group, you can see total charges, amount collected (including adjustments), and then the “Amount Deposited (all pmts)”. Your practice can use the Amount Deposited column to review your income from each insurance group for each quarter.

The “Personal / No Insurance” row displays data for patients who are self-pay, without any assigned insurance plan.

If you have more than one Medicaid insurance group, you should add up the “Amount Deposited” columns for those groups when reporting on Medicaid payments.

Similarly, in order to calculate your Commercial/Private Insurance payment amounts, add the total Amount Deposited for any private insurance groups in the report.

Export and Save Your Report

Press F4 – Send To... to email or print the report. Although you can rerun the report at any time, you may wish to keep the report on file.

You can also export the data for use in a spreadsheet.

Use the Report Amounts to Report Your Revenue Loss

To learn how, visit https://prfreporting.hrsa.gov/s/ .