Reverse an Insurance Payment (Post a Takeback)

When you receive an insurance payment reversal or “takeback” from a payor, you can post it automatically or manually.

Video: Watch Reverse an Insurance Payment (Post a Takeback) to learn more.

Contents

Automatically Post Reversals

When you autopost an ERA that contains a payment reversal, PCC EHR can usually post both the reversal and the updated adjudication from the payor. When this occurs, a reversal adjustment is linked to the original payment and associated with the provider of the originally linked charges.

However, your PCC system cannot automatically post a reversal if any charge, payment, or claim detail does not match what is found in your PCC system. For example, if the amount reversed does not match your records, or the payor fails to provide identification information, the takeback will not autopost and you will see it when you review the ERA after autoposting and on the Posting Exceptions worklist.

Read Post Insurance Payments to learn how to autopost an ERA and then review responses that could not be posted.

If a reversal cannot be automatically posted, or you received a paper notification of the reversal, you can post it manually in the Insurance Payments tool using the procedure below.

Manually Reverse an Insurance Payment

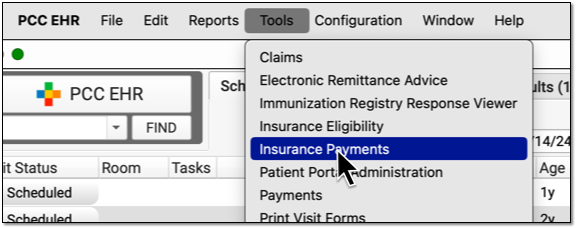

Open the Insurance Payments Tool and Find the Patient

Open the Insurance Payments tool and find the patient for the takeback.

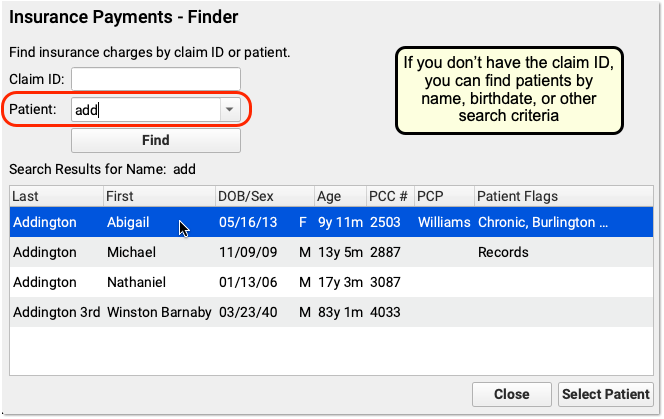

Select the Payment the Payor is Reversing

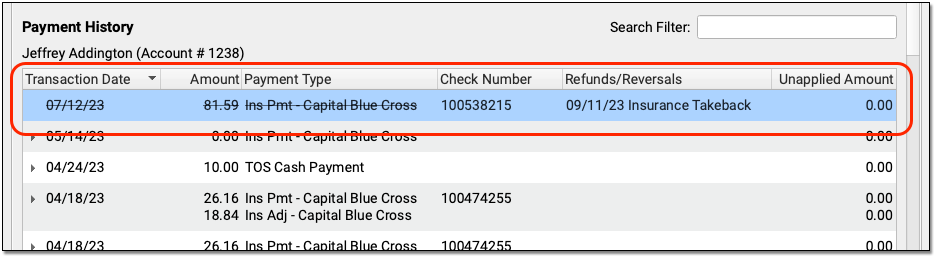

On the History tab, find and select the payment that must be reversed.

You can use the Search Filter and the disclosure triangles to ensure you have identified the payment and adjustment indicated by the payor.

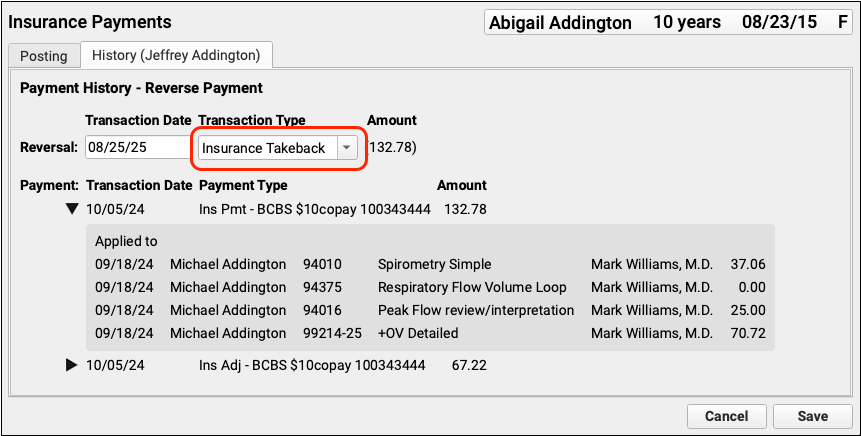

Click “Reverse Payment”

Click “Reverse Payment”.

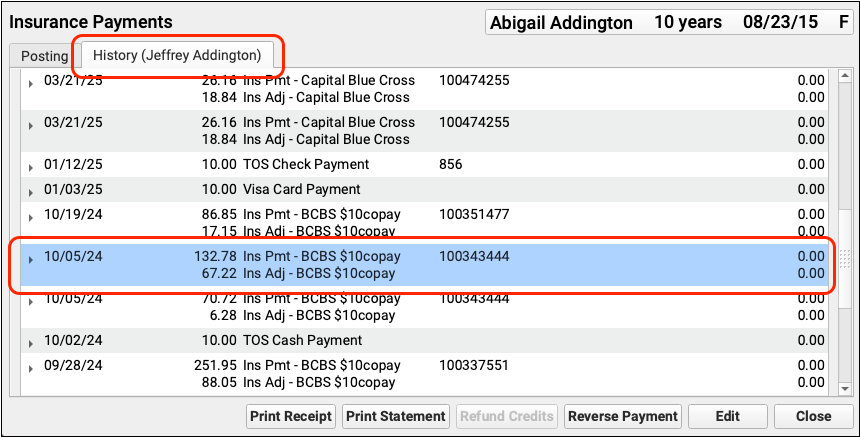

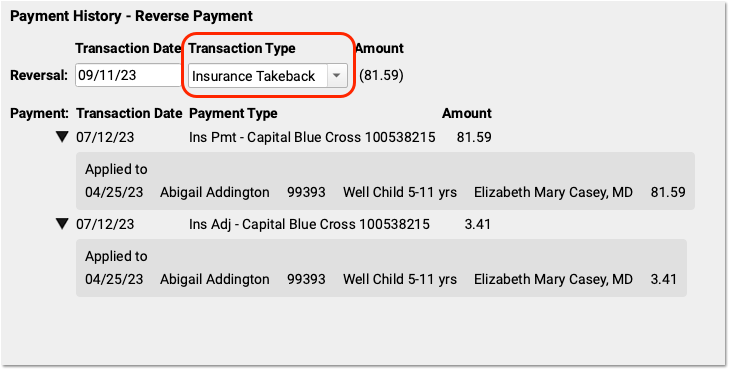

Update the Transaction Date and Select a Transaction Type

On the Reverse Payment screen, optionally update the transaction date for the reversal. Then select an appropriate Transaction Type, such as a “Takeback” adjustment.

As you finalize your selection, you can use the original payment details on the screen to double-check that you are working with the correct encounter.

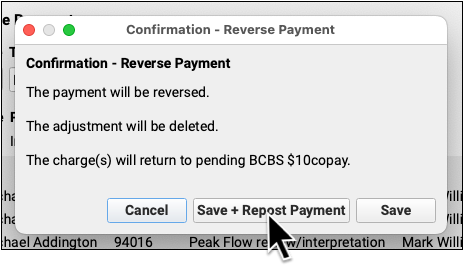

Click “Save” and Choose Whether to Repost

Click “Save” and then decide whether to repost the payment while making changes to the adjudication, or just reverse the payment.

After you make a selection, the payment will be reversed and any adjustment(s) deleted. The encounter charges will pend the original payor.

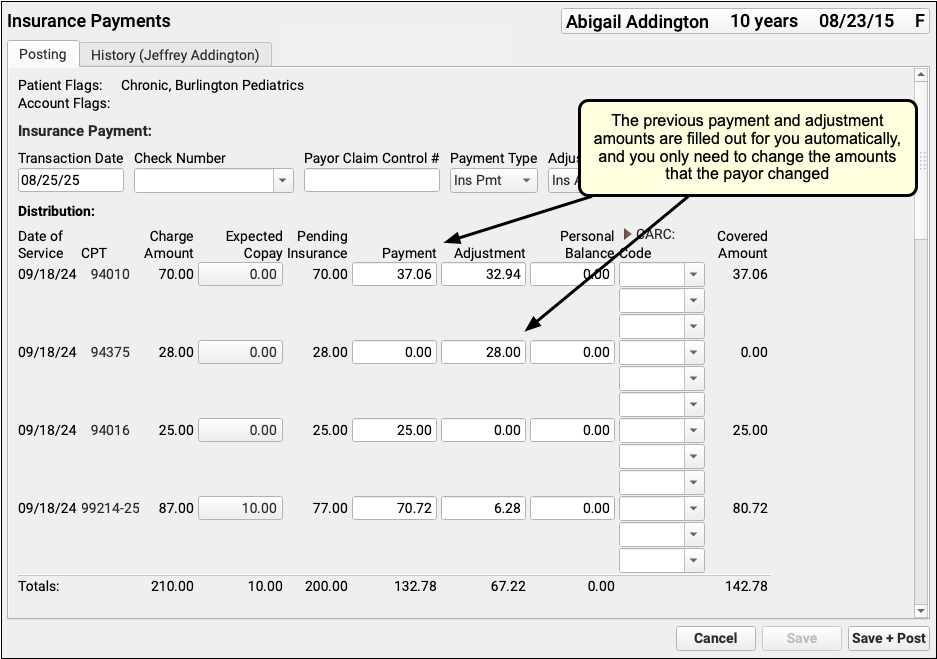

Post Updated Adjudication, or the Denial, and Add an Account Note

On the posting screen, you can review how to original payment was applied and make the changes found on the new ERA.

Typically, an ERA or EOB that indicates a reversal also includes updated adjudication information for the encounter.

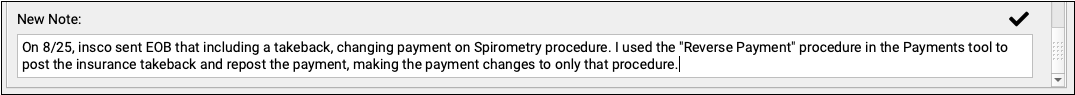

As you post the updated payor response, you can use the components on the screen to update policy information, contact the family, and record additional details about the reversal in Account Notes.

Review the Results

Back on the History tab, you can review that the original payment is struck through, with the date and reversal transaction listed in the Refunds/Reversals column.

Reversing a Payment Posts an Adjustment: When you reverse a payment, you create an adjustment that links to the original payment. The adjustment behaves like any charge or procedure on your PCC system, and it is associated with the provider of the original charge (or charges) paid off by the payment.

Reversals That Appear With Other Encounters vs Sending a Check: After you post a takeback, you might continue posting other responses on the same ERA. The check’s total is often lowered by the reversed amount, and when you run reports to review posting, you will see the takeback among the other payments. In some cases, however, you may be required to mail a check to the insurance company.

Undo an Insurance Payment Reversal

If you post a takeback incorrectly, you can contact PCC Support or use the under-the-hood Correct Mistake (oops) program to unlink the original payment from the Insurance Takeback, delete the Insurance Takeback adjustment, and then link the payment back to encounter charges.

Configure Transaction Types for an Insurance Payment Reversal

When you post an insurance payment reversal or “takeback”, you select a Transaction Type to record the event.

Your PCC system should already have an “Insurance Takeback” or “Insurance Reversal” transaction type, which you can pick from the drop-down menu.

If you need to edit or update the available transaction types, use the Procedures table in the Tables tool. All procedures with an accounting type of “Receipt – Refund” are available in the Transaction Type drop-down menu when you post an insurance reversal. For help making changes, contact PCC Support at 802-846-8177 or 800-722-7708 or support@pcc.com.

Reverse an Insurance Overpayment from an Overpayment Holding Account

You may receive an insurance reversal for a payment you posted to an overpayment holding account. If so, you can post a refund to that account and link the payment to that refund, releasing the amount to either be sent back to the insurance company or applied to charges on the new ERA.

To learn more, read Post Capitation Checks, Incentive Payments, Interest Payments, Overpayments, and Withhold Payments.

Review Insurance Reversals on End-of-Day Reports

You can review aggregate data of all refunds over a period of time with the Total Charges and Payments by Provider and Month report.

To see line item details for insurance reversals, along with all payments and adjustments, run the the daysheet report. Run daysheet, choose the “wide” report, and review the NSF/Refunds column.

Insurance reversals do not show up on the deposit report. Posting the reversal along with other payments on an ERA will increase the day’s deposit total, but deposit does not display “negative” payments. When you perform an insurance takeback, you should note this variance and share your actions with the other billers in your office. You can use the daysheet report to ensure your end-of-day numbers match expectations.