CARC and RARC Values in PCC

When insurance carriers send payment and adjustment information, either on an EOB or an ERA, they often include a code with a small message. These codes are known as CARC values, or Claim Adjustment Reason Codes, and they are an industry-wide standard. CARC values can include a code, an amount, and an additional group code.

Remittance Advice Remark Codes (RARCs) provide additional explanation for an adjustment already described by a Claim Adjustment Reason Code (CARC). A RARC can be supplemental or informational.

PCC stores and displays CARC information to help you understand charge history, communicate adjustment information on patient bills, and submit secondary claims.

Contents

CARC Workflow Example

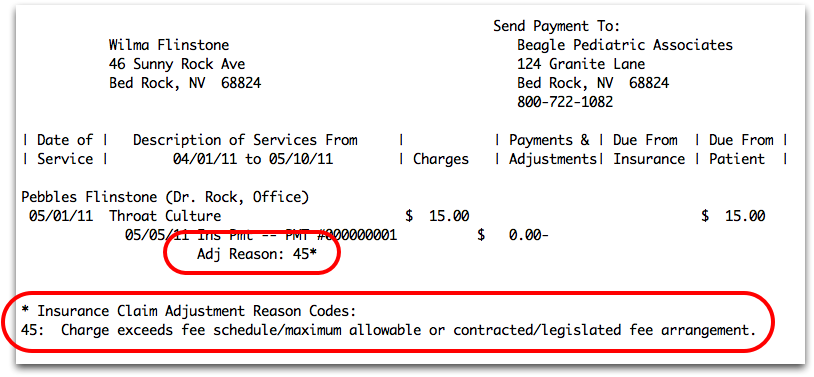

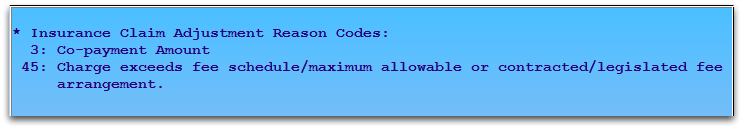

You may see a 45 on your EOB or ERA, with a note indicating that 45 means, “Charge exceeds fee schedule/maximum allowable or contracted/legislated fee arrangement.” Number 45 is the most common CARC value, and it indicates that the payer has adjusted your charge to their pay schedule.

If PCC received the remittance electronically, it will record “45” when it automatically posts the payment and adjustment.

If you are posting a payment by hand, you can enter 45 when you Post Insurance Payments manually, along with a CARC amount and group, if provided.

You can review the CARC information in most places where payment history appears, such as the Correct Mistakes (oops tool, the Account History (tater) report, and on personal bills.

Common CARCs

While there are hundreds of CARC values, the common ones comprise most of the codes you will receive. Here are the top nine:

|

CARC Value (in order of popularity) |

Message Text |

|---|---|

| 45 | Charge exceeds fee schedule/maximum allowable or contracted/legislated fee arrangement. |

| 42 | Charges exceed our fee schedule or maximum allowable amount. |

| 97 | Payment adjusted because the benefit for this service is included in the payment/allowance for another service/procedure that has already been adjudicated. |

| 22 | Payment adjusted because this care may be covered by another payer per coordination of benefits. |

| 96 | Non-covered charge(s). |

| 104 | Managed care withholding. |

| 18 | Duplicate claim/service. |

| 24 | Payment for charges adjusted. Charges are covered under a capitation agreement/managed care plan. |

| 144 | Incentive adjustment, e.g. preferred product/service. |

How CARC Codes Get Into the Account Record in PCC

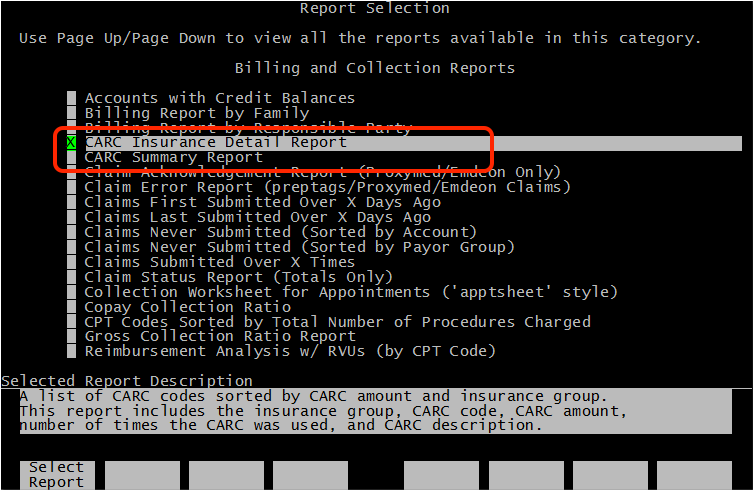

CARC values enter your PCC system through autoposting. Both CARC and RARC can be used as criteria for whether an ERA can be autoposted. You can also enter CARC values manually.

Autoposting ERAs Imports the CARC to the Account Record

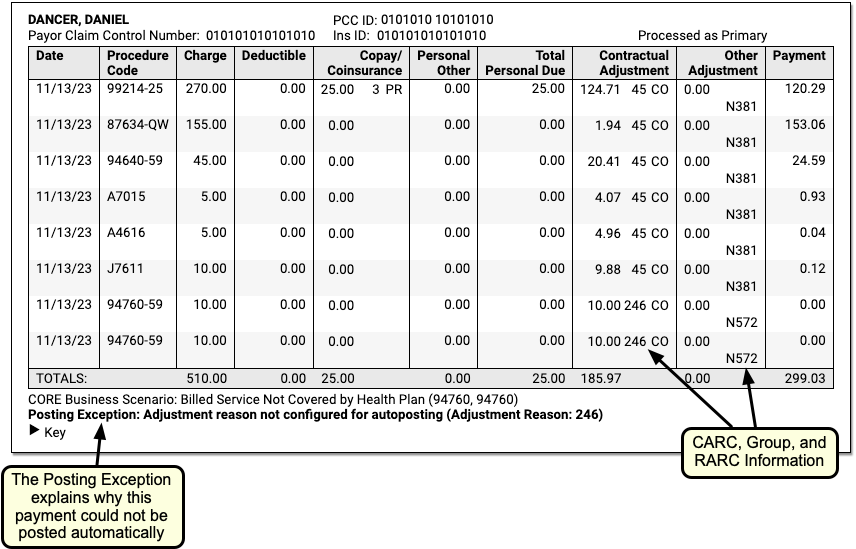

The Autopost Insurance Payments program (autopip) receives and records CARC values found on ERAs.

When you post insurance payments using autopip, PCC posts the CARC codes indicated by the carrier, if any, along with the amount and group codes which are needed for secondary submission.

PCC keeps the ERA on file so you can review both the CARC and RARC codes later in the ecsreports program or Correct Mistakes (oops).

CARC and RARC Codes Are Used as Criteria for Requiring Manual Attention

Your practice can configure which CARC or RARC should stop an incoming ERA from being automatically posted. Based on your choices, ERAs with certain CARC or RARC values can “drop to manual” for your review and direct attention.

Contact PCC Support for help configuring automatic payment posting in PCC.

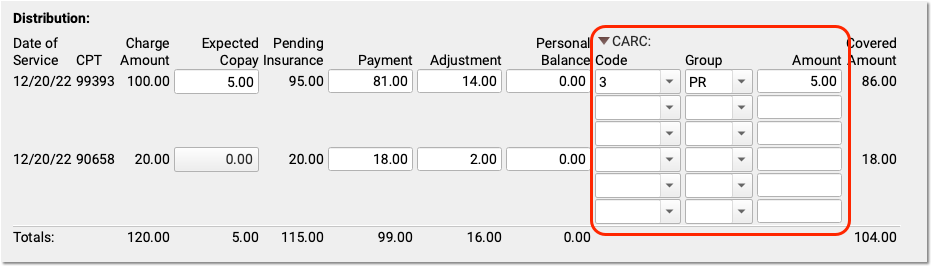

Enter CARC As You Manually Post Payments

You will see CARC values on your EOBs and ERAs from most carriers. You can enter CARC values when you post payments and adjustments manually.

For each charge, you can enter a CARC amount, code, and group code.

Do Not Post Other Carrier Codes in CARC Fields: If your insurance carrier uses a non-CARC system of coded messages, do not post them in the CARC column. CARC values are a national standard and do not match up with Georgia Medicaid message codes or other carrier codes. Instead, some PCC users use payment and adjustment types to indicate messages from carriers.

Where Can I Review CARC and RARC Values in PCC?

Once CARC values are entered with payments, where can you find them and how can they benefit your day-to-day work? Is there a way to review RARCs that came in electronically?

CARC and RARC Values Appear in the Original ERAs

While you can automatically post most payments and adjustments, you can also read the original ERA 835 files sent from payors, which include all CARC, RARC, group and amount values. See ERA 835s from Payors to learn more.

CARC and RARC Values Appear in Correct Mistakes (oops)

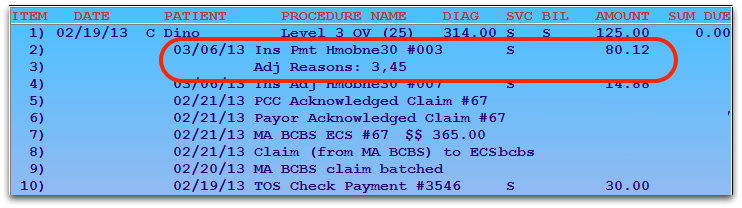

In the Correct Mistakes (oops) tool, CARC codes appear in line with insurance payment information.

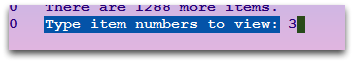

Press F7 – View Adj Reasons and enter an item number to read CARC, RARC, and descriptions.

CARC in the Account History Report (tater)

CARC values entered automatically or manually also appear in the Account History Report (tater).

CARC Values Appear on Personal Bills

PCC’s personal bills, whether printed in your office or through a remote ebills service, include CARC values and an explanation of what they mean.

You can review the text of any personal bill and see the adjustment reasons in the Correct Mistakes (oops) program.